Challenges for the decarbonization of short sea shipping

The pressure to accelerate the energy transition is accompanied by new regulations from both the IMO (International Maritime Organization) and the European Union, a crucial challenge for the decarbonization of Short Sea Shipping. The search for and implementation of new fuels and the development of Onshore Power Supply systems pose technical challenges and operational cost implications. PierNext has gathered a variety of cross-sectoral viewpoints during two recent professional events.

Emissions reduction... at any cost?

Short sea shipping faces multiple challenges.

- On the one hand, recent global tensions have triggered conflicts in different parts of the world, slowing down the usual flow of maritime goods.

- On the other, decarbonization. Through stricter regulations on fossil fuels and the promotion of more sustainable alternatives, the maritime industry is geared toward reducing greenhouse gas emissions, with the goal of achieving climate neutrality by 2050.

But trying to solve these problems entails a high operational cost for all companies and entities in the sector.

During the last Short Sea Shipping 2024 Annual Conference, organized by the Shortsea Promotion Centre Spain and held in Barcelona, multi-sector and institutional representatives were able to state their position on the importance of Short Sea Shipping in decarbonization.

For Gesine Meissner, European Coordinator for the European Maritime Space, Short Sea Shipping plays a very important role in meeting climate objectives: "It offers a significant opportunity for regional development, while helping to reduce greenhouse gas emissions through the adoption of new fuels and precautionary technologies. And in this context,” he said, ‘it is essential to recognize the new role of ports as energy hubs’.

“For maritime transport to be considered combined, it must reduce its external costs by 40% compared to road transport,” explained Miguel Núñez, the government's transport advisor and Spain's permanent representative to the EU. Núñez placed special emphasis on the need for financial entities and governments to create support mechanisms to facilitate this transformation. "Investment in sustainability is not just an option, it is a necessity. Without adequate support, progress will be slow and limited,” he said.

In that sense, during the conference Elena Seco, president of SPC Spain (Spanish Association for the Promotion of Short Sea Shipping), pointed out that “regulations such as the Maritime Fuel EU and the Emissions Trading Directive are fundamental steps to transform our sector. However, it is vital that all industry players work together to facilitate this transition. The implementation of adequate infrastructure for alternative fuels and the creation of fiscal incentives will be key to achieving these goals.”

Challenges in the implementation of regulations

Participants made it clear that one of the major drawbacks of decarbonization measures is uncertainty, how the applicability of regulations such as the Emissions Trading System (ETS) or the Maritime Taxation Directive, for example, will be affected.

“We are concerned about how it will be audited and how it will affect the competitiveness of the sector,” lamented Miguel Núñez. And this was also remarked by the Director General of the Spanish Merchant Marine (MITTIS), Gustavo Santana: “We are facing the question of how to achieve zero emissions, but we do not have a clear direction yet, although the need to act is imperative”.

The control of the use of alternative fuels is uncertain and, as Juan Carlos Arocas, Managing Director of Iberia Transitalia, added, “regulations that negatively affect competitiveness should not be approved”.

The Combined Transport Directive continues to generate controversy in the maritime sector, despite being intended to encourage the transition to more sustainable modes of transport: “Initially, the European Commission considered excluding Short Sea Shipping because of difficulties with intermodality and distances, but they decided to include it to make maritime transport a more competitive and environmentally friendly option,” said Santana.

In addition, the absence of a clear and definitive alternative to diesel is generating growing concerns and tensions among ocean carriers. The lack of standardization and the feasibility of supplying sustainable fuels on a large scale remain significant challenges. A “winning horse” in terms of green fuels has yet to be identified, leaving shipowners in an uncertain situation as to which to choose. The investments required to adapt to new fuels are high and the supply of some, such as green methanol, is still limited. As Elena Seco pointed out, "there is currently no zero-emission solution.

Therefore, the shared concern is clear: if regulations end up driving up costs for both businesses and citizens, the design of the directive will need to be reviewed to ensure that, rather than penalizing, it truly drives a sustainable and viable transition.

Sustainable alternatives: the new but complex hope for SSS

During a conference organized by the Col.legi d'Enginyers Industrials de Catalunya on the reform of the CO2 market in maritime transport, Elena Seco, also General Director of the Spanish Shipping Association (ANAVE), explained that “although transport represents 25% of global CO2 emissions, within that percentage, maritime transport contributes between 2.5 and 3% of global emissions. As this sector is the most efficient for global trade, it is shocking that 99.9% of the fuel used still comes from fossil fuel sources”.

Therefore, the transition to sustainable fuels is crucial to achieve decarbonization goals, and options such as methanoland ammonia play a key role as hydrogen carriers.

- In particular, “green” methanol stands out for its ability to reduce emissions, provided its production is 100% sustainable. However, it requires additional safety systems, such as cofferdams (safety compartments) to prevent leaks, and would require twice as much space to generate the same amount of energy as conventional fuels. For these reasons, their production and market introduction is still limited.

- On the other hand, the first engines running on ammonia are already on the market. However, its high toxicity presents significant safety challenges. For ammonia to be used safely and effectively, the implementation of new IMO regulations and specialized training for crews in the handling of this type of fuel is crucial.

But which is the better alternative?

Both require major investments in infrastructure and have technical characteristics that can lead to other types of environmental problems. The toxicity of these new renewable fuels is one of the main discursive axes of the decarbonization process, which generates more uncertainty and delays investment in new technologies.

That is why Elena Seco acknowledged that one of the fears of shipowners is that if they invest in a technology that is later banned or limited, as happened with exhaust gas scrubbers, their efforts will be in vain.

In fact, Fernando Barreras, Division Director of Suardiaz Energy, warned during the Short Sea Shipping 2024 Annual Conference that while timetables for decarbonization can be set, they have been overly optimistic and extensions to the timelines are likely to be needed.

The most effective measures focus on the energy efficiency of ships, such as the implementation of lubrication systems, the use of sails , and the adoption of biofuels and green liquefied natural gas (LNG). For example, batteries and fuel cells could be viable, but only for short journeys.

Laura Tillero, Business Development of Marine Fuel Solutions at Cepsa, also warned that “without standardization we will not be able to move forward. If companies comply efficiently, they will benefit, but price is still an obstacle. We are advising our customers on how to scale up alternative fuel production.”

Catalysts for sustainability in multimodal transport: eco-incentives and ETS

Industry knows that without a firm commitment to the energy transition, operating costs will increase in the long term. In this context, the EmissionsTrading Scheme (ETS) and regulations such as eco-incentives are key tools in the EU climate framework to achieve climate neutrality by 2050 and meet the Fit for 2050 package. These regulations are designed to boost sustainability in multimodal transport and reduce greenhouse gas (GHG) emissions.

But which of these measures has the most support in the industry, and is there really a consensus on how to implement them?

While the ETS is a limiting system and generates a permit market, eco-incentives encourage green investments through subsidies or tax benefits. In contrast to what many see as a “punishment”, the outcome of this balance between reward and penalty is necessary in order to establish a level playing field where the maritime sector can engage in sustainable development more comfortably.

But despite being complementary regulations, their practicality may be causing friction in the industry. Growing tensions in the bunker market and the price to be paid for adopting new sustainable measures are putting the economic viability of many shipping lines at stake.

Many feel that this combination of regulations is not entirely fair and question the effectiveness of the ETS. “It's about improving competitiveness, not imposing more taxes or regulations that hinder maritime service,” said Arocas.

The ETS brings with it significant challenges: permit costs and penalties for exceeding emissions limits could raise transport prices. Arocas summed it up clearly: "the measures must be consistent and not harm competitiveness; companies cannot take on unsustainable costs without affecting their market position.” In this sense, eco-incentives offer partial relief, helping to reduce the cost of implementing sustainable solutions.

For these regulations to have a positive and lasting impact, their effectiveness will depend on global harmonization.If other countries do not apply similar regulations, European shipping companies could lose competitiveness. Therefore, expanding these policies internationally is key to maintaining a level playing field in the maritime sector and promoting sustainable and effective change.

Consistent measures to avoid compromising competitiveness

The decarbonization of shipping obviously has significant economic implications, both for shipping companies and for international trade. This transition towards more sustainable practices may, in fact, alter market dynamics and the competitiveness of companies.

Arocas, Managing Director Iberia Transitalia, also warned about the difficulties of the sector by pointing out the importance of “measures being consistent and not compromising the competitiveness of companies”. In this context, resistance to change is understandable, as the costs associated with the transition to more sustainable technologies and fuels are high.

This directly affects the competitiveness of companies, which face an uncertain scenario in terms of the profitability of their investments. This raises the following question: is it possible to establish a balance between sustainability and economic viability without companies losing competitiveness in an increasingly demanding global market?

Hèctor Calls, director of environmental sustainability and energy transition at the Port of Barcelona, believes so, as he explained at the conference organized by the Col.legi d'Enginyers Industrials de Catalunya: “In recent years transport costs have increased by 200%. And the world has continued to function! In 2023 we are back to pre-pandemic transport costs. We have gone up and back, haven't we? Now what's coming is the fight against climate change - aren't we going to adapt in the same way?”

The energy transition of ports

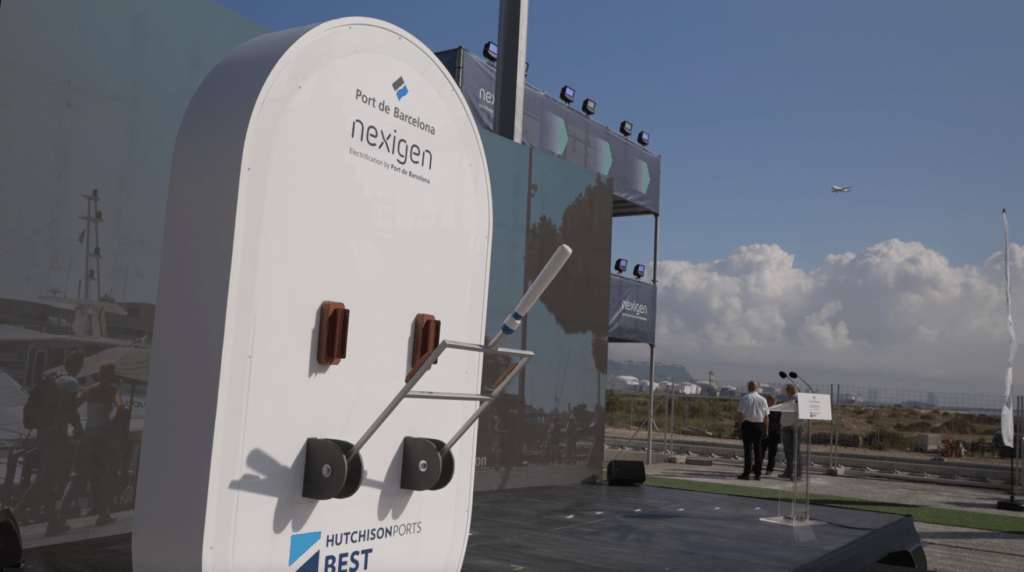

Calls also explained that the key factor of the energy transition plan is also to focus on the decarbonization of ports, not only on ships. And he gave as an example the “pioneering” Energy Transition Plan of the Port of Barcelona, which “more than complying with the rules, aspires to lead the change in sustainability by making a difference throughout Europe,” he added.

In addition to the use of sustainable fuels and the circular economy, the electrification of the port is one of the key pillars of this sustainable development plan. The idea is that the docks, terminals and all port machinery will be connected to the electricity grid. The docks will be equipped with the Onshore Power Supply (OPS) system, an infrastructure that will allow ships to connect to the shore power grid and stop relying on fossil fuels while docked, thus reducing emissions.

Its implementation is underway, but there are complexities in the port infrastructure.

The Head of Business Development of Vinci Energies, Jorge Roca, had already pointed out during the Short Sea Shipping 2024 Annual Conference that each port has different structural characteristics, which adds difficulties to the construction of OPS infrastructures and the cybersecurity of the system itself. In addition, this project requires meticulous and coordinated planning with the terminals in order to minimize the impact on the daily operations carried out in the port.

But the Port of Barcelona has already taken the first step and, although the challenges of the decarbonization of short sea shipping are many and diverse, the sector, as we can see, is facing them.

Regulation by regulation and always open to innovation.