How the ports industry as a whole may develop is relevant for the strategy of Barcelona. (Gettyimages)

How the ports industry as a whole may develop is relevant for the strategy of Barcelona. (Gettyimages)

4 social trends, the key to ports in 2040

A joint project of Port of Barcelona, BlueFocus and Ports & Logistics Advisory offers a deeper understanding of trends and developments and their long-term impact on ports. The project is an input for Barcelona’s upcoming vision for 2040. This article focuses on the main expected changes in the societal and consumption patterns.

Xavier Roca is Managing Partner of blueFocus, a strategy and operations consultancy.

Dr. Peter de Langen is the owner and principal consultant of Ports & Logistics Advisory, co-director of the knowledge dissemination platform porteconomics.eu.

How the ports industry as a whole may develop is relevant for the strategy of Barcelona. (Gettyimages)

How the ports industry as a whole may develop is relevant for the strategy of Barcelona. (Gettyimages)

The trend project of Port of Barcelona, BlueFocus and Ports & Logistics Advisory took shape in the middle of the COVID-19 pandemia, with a dramatic disruptive effect on global trade and thus also volumes handled in ports. For all the right reasons, currently the focus is on the ‘here and now’: many companies and families worry about how to survive the coming months. But crisis and change often go hand-in-hand, and the corona-crisis may accelerate some trends that were already in the making, so this may well be a time to look beyond the business as usual.

This project took a broad approach, with a focus on global trends and developments, as well as an analysis of their impact on a European scale. This approach was taken as insights in how the ports industry as a whole may develop is relevant for the strategy of Barcelona.

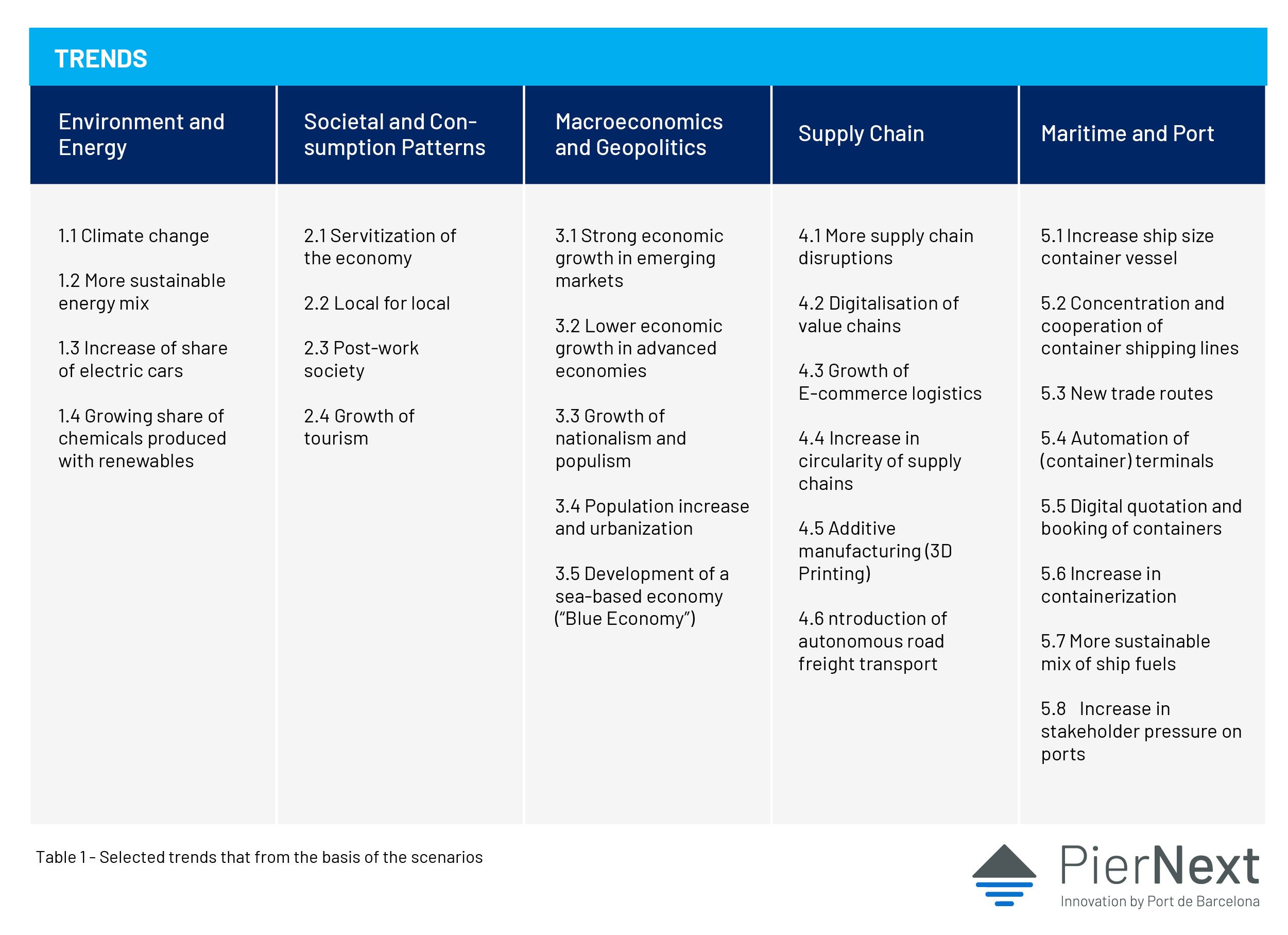

The number of trends that impact ports is huge and very diverse, as ports themselves encompass a variety of activities, ranging from leisure to warehousing. 27 trends were selected based on their potential impact on maritime supply chains and port operations. Some trends that also may seriously impact ports are left out, but these 27 trends taken together provide a good overview of the changing environment ports operate in. The trends are split in five different categories (see table 1).

One of the identified trends (4.1) is that supply chains face more disruptions than before, because of the increasing global interconnectedness. The rapid global spread of COVID-19 and its impact on global value chains are illustrations of this trend.

Describing each of these trends would be too much of a strain, this article is focused on the societal trends. As a bit of an academic side-note: this choice is partly because awareness in the port community of societal trends is often limited. This is due to the large ‘cognitive distance’ (divergence of direct experiences) between the port community and the wider (urban) society ports are embedded in. The larger the cognitive distance the more likely it is that emerging trends are not noticed or ignored. In practical terms: port managers will certainly be knowledgeable about changes in ship sizes: they regularly speak with shipping lines, attend the same events and read the same specialized media (such as Lloyds List).

Port managers may not fully acknowledge the effects of trends outside their professional experience, such as the servitization on supply chains and other societal trends. This leads to a risk that societal trends with a disruptive impact on ports are not noticed or ignored for too long. That’s why they are discussed here.

Four societal trends

We have identified four societal trends with an impact on ports: the servitization of the economy, the increase of a local-for-local economy, the ongoing growth of tourism and the shift towards a ‘post-work society’.

Servitization is the trend that companies replace products for services. Manufacturers increasingly sell a service and retain ownership of assets such as printers, trucks, cars, cranes, fridges, ship engines and heating systems. This applies both to business-to-business (B2B) services and business-to-consumers (B2C) services. In many industries, the shift towards services improves the utilization of assets (cars, homes and even washing machines), in some industries it even does away the need for specific products. For instance, music and videos are streamed and no longer sold as products.

And is driven by digitalization, which for instance allows much better planning and predictive maintenance. Across most manufacturing sectors, a radical servitization is widely expected. Commodities that are very relevant for ports include cars and trucks. For both, it is widely expected that private ownership will gradually be replaced with ownership by manufacturers and mobility providers (like Uber). In the case of cars, the impact on volumes is likely to be huge: privately owned cars are only used 5% of the time.

The shift to ‘Mobility as a Service MaaS’ will lead to radically improved utilization rates. As a consequence, the required stock of cars is much lower. This reduces annual new car sales; how much depends mainly on the ‘life cycle kilometres’ of cars deployed in a MaaS model. If that number rises substantially, annual car sales will fall substantially. And with that, the volume or cars handled in ports will fall as well.

The second important societal trend is the transition towards a ‘Post-work society’ in which work occupies a less central position. Technological progress results in increasing productivity. Technology (for instance robots, artificially intelligent machines and digital technologies) eliminates many “routine manual” and “routine cognitive” activities, notably in factories and offices, from taxi drivers and factory workers to accountants and translators. In ports, direct employment is on the decline for decades and likely to decline further, with digitalisation likely to wipe out traditional forwarding activities and automation likely to reduce the need for terminal workers. The increasing productivity enables increasing income levels and in combination with the automation of many jobs, leads to reduced working hours. Labour unions are strong advocates of reducing working hours, partially because high shares of workers are faced with work related health issues (such as stress and burn-outs).

Some companies embrace shorter workweeks, for instance by installing 25-hour workweeks, to make their employees happier and more productive -and the company more profitable. Radical policy proposals, such as a universal basic income gradually become more mainstream. This trend slows the economic growth in advanced economies while enabling growth of tourism -the third important societal trend.

The third trend is the continuing growth of tourism. Tourism has grown for centuries and is expected to continue to grow. This growth is driven by economic growth, especially in emerging economies, reduced workweeks and reduced passenger transport costs. Due to massification, tourism also has adverse social and environmental effects. Especially in ‘heritage cities’, the growth of tourism leads to active tourism management, with the aim to reduce the negative effects associated with tourism.

A final societal trend concerns the rise in ‘local for local’ consumption. The increasing awareness of the negative side-effects of global value chains leads to an increasing demand for local products. This trend is the strongest for food products, where local products are more sustainable and sometimes also of a higher quality because of the shorter time-to-market. European consumers strongly prefer locally produced food. Various cities/regions promote the use of local food, for the health impact as well as the positive economic effects. Initiatives for ‘urban farming’, local produce markets and delivery of local products have emerged in many (European) cities. While the trend is most clearly visible for food, it applies more broadly, for instance to products like clothing.

The COVID-19 impact on these trends

Coronavirus accelerates digitalisation, and in some cases the associated servitization. Some of the ‘lost car sales’ from 2020 may never come back as people switch to mobility as a service offerings. The transition to a society in which work occupies a less central place on the one hand loses traction as the crisis is deeply impacting prosperity but on the other hand, some countries have introduced temporary universal basic income payments and UBI is promoted as a way to make societies less vulnerable economically.

Additionally, the accelerated introduction of teleworking, if maintained after the crisis, can affect mobility patterns and reinforce this post-work society. COVID-19 also deeply affects tourism, with a forecasted decline of revenues of over $300 billion in 2020. However, the ‘fundamentals’ for tourism growth remain strong, the main long-term effect may be a reduced concentration of tourism flows in specific destinations and attractions. Finally, the trend towards ‘local for local’ consumption may accelerate, partly as a result of initiatives to buy local to help local enterprises, and partly because cities and countries increasingly recognize that using local products make them more resilient.

What to expect

How is all of this relevant for ports & port development? The impact of all trends has been analysed in cooperation with academic experts from the knowledge dissemination platform PortEconomics. The assessment suggests for instance that the downward effect of local-for-local consumption on global (food) flows is relatively low. The trends impact value chains, often (for instance for automotive) in disruptive ways. This calls for resilient port operations and flexible port planning.

Overall, the impact of all the trends listed in table 1 suggests dry bulk volumes are likely to decline somewhat and liquid bulk volumes substantially. Container and RoRo volumes may grow, but with growth levels substantially below those of the last decades. For ports, tourism and leisure related segments such as cruise, leisure facilities, yachts and marinas are among the clearest growth segments. Thus, many ports may benefit from freeing up space to accommodate tourism & leisure related activities.

Trend analysis may also be useful for generating ideas about new initiatives of port authorities. For instance, for Barcelona, the growth potential of tourism & leisure and the increasing stakeholder pressure on ports combined suggest ports need to invest heavily in securing societal support for tourism & leisure activities in the port. Perhaps the ‘local for local’ trend can be used to increase the ‘value for society’ of tourism and leisure activities?

For instance, Port of Barcelona, together with other stakeholders, may cater a demand from passengers for local products/experiences by developing a register of local suppliers (food, excursions and other products and services) that meet a certain set of criteria (which could include social criteria) with the aim to grow the revenues of these suppliers from cruise companies. Such a register enables the cruise companies to generate more positive societal impacts of cruise visits through increasing local purchases in the ports they visit. Port authorities may deploy tariff or regulatory instruments to secure such a growing positive societal impact. This may help to create a societal ‘license to operate’ that is critical in ports in tourism destinations such as Barcelona.

Note: this example is an illustration of an idea that emerges from analyzing trends and their impacts, not a mature project plan ready for implementation. Hopefully, it serves to illustrate how trend analysis can help in port development.