What do ports invest in?

80 billion euros. This is the value of the investments that will be needed by the bodies that manage European ports in the next decade to meet and address the remaining challenges in sustainable energy, industrial clusters and geopolitical resilience. So reveals a study by ESPO and Dr. Peter de Langen conducted on European ports. We spoke with its author to learn more about the various aspects of this report.

Big challenges, big investments.

This is what The investment pipeline and challenges of European ports, published by the European Sea Ports Association (ESPO) and Dr. Peter de Langen, owner and principal consultant at Ports & Logistics Advisory and co-director of the platform porteconomics.eu. This is the second study of its kind to be published on the status and focus of investment in European ports.

The study analyzes the investment needs of 84 entities in charge of managing European ports to obtain a current snapshot of the situation. It is worth noting that the number of ports participating in the previous study, which dates back to 2018, was 60. The increase is remarkable because it represents, in de Langen's words, more than 70% of European foreign trade.

Focus on sustainability

Compared to six years ago, investments in sustainability and energy transition have gained weight; from a share below 10% they have risen to 25%.

"Previously, almost a third of all investments were focused on physical expansion of ports which was by far the largest category. In 2023-24 they continue to occupy almost a third of investments, but the one that has risen the most is those aimed at sustainability, which shows that the type of investments is changing," explains de Langen.

Given its breadth, this category is subdivided into different typologies of related investments. For example, a large portion consists of investments in:

- "infrastructures and services related to the energy transition of the economy" (55 projects in total),

- Another significant one consists of investments in "infrastructures and facilities to reduce the environmental footprint of maritime transport" (54 projects).

- To a lesser extent, they are for "investments to reduce the environmental footprint of port operations" (8 projects).

"In line with what the study reflects, in recent years the Port of Barcelona has developed a long-term strategy to mitigate environmental impact and promote the decarbonization of the logistics chain. This increased environmental sensitivity is evident in the IV Strategic Plan, which sets an ambitious target: a 50% reduction in greenhouse gas (GHG) emissions by 2030 compared to 2017," explains Miriam Alaminos, deputy general manager of Economic and Finance at the Port of Barcelona.

In the case of Barcelona, the economic figures accompany this goal. Alaminos confirms that the 2020-2024 Investment Plan envisaged an investment of only 17 million euros associated with this type of project, while in the 2025-2030 Investment Plan this amount already accumulates 163 million euros.

"Thus, in 5 years, we have practically multiplied by 10 the investment commitment in actions related to sustainability," she emphasizes.

Onshore Power Supply, 'green' flagship project for European ports

Among the most relevant projects, almost two thirds of the ports plan to start offering onshore power (OPS) to ships, while the rest (with some exceptions) already provide these services. Along the same lines, truck loading facilities, green energy supply to companies operating in the port, clean fuels for ships and digital energy management services are being sought.

In the case of Barcelona, the Nexigen project confirms this first trend, as well as being the most economically relevant project, with an allocation of 126 million euros.

"Nexigen includes, on the one hand, the electrification of the docks themselves, whose deployment has a total budget of 90 million euros, the electrical connection to a new substation, with a budget of 21 million euros, and an additional infrastructure investment of 15 million euros," she specifies.

Aligning national and European strategies

"Another objective is to try to attract investment in industries that do not generate emissions. This is the case of quite a few Danish ports, in whose facilities the offshore wind industry is built and integrated. This industry is huge and the type of investment is different. The port of Esbjerg is an example; it has invested a lot in expanding its spaces to accommodate this industry," shares de Langen.

The leap in sustainability investments is a response to the responsibility that European port managers are taking to decarbonize the sector and align themselves with the objectives set by Europe.

As the expert reminds us, the vast majority of ports are public entities, with the exception of Greece and a couple of cases in the Baltic countries, which means that their objectives are not only commercial, but must be aligned with national or European policies.

"They must be a leader in this transition to greater sustainability and clean energy. The vast majority of ports have taken on this role, as well as adhering to European policies, even if these investments are far from profitable," de Langen notes.

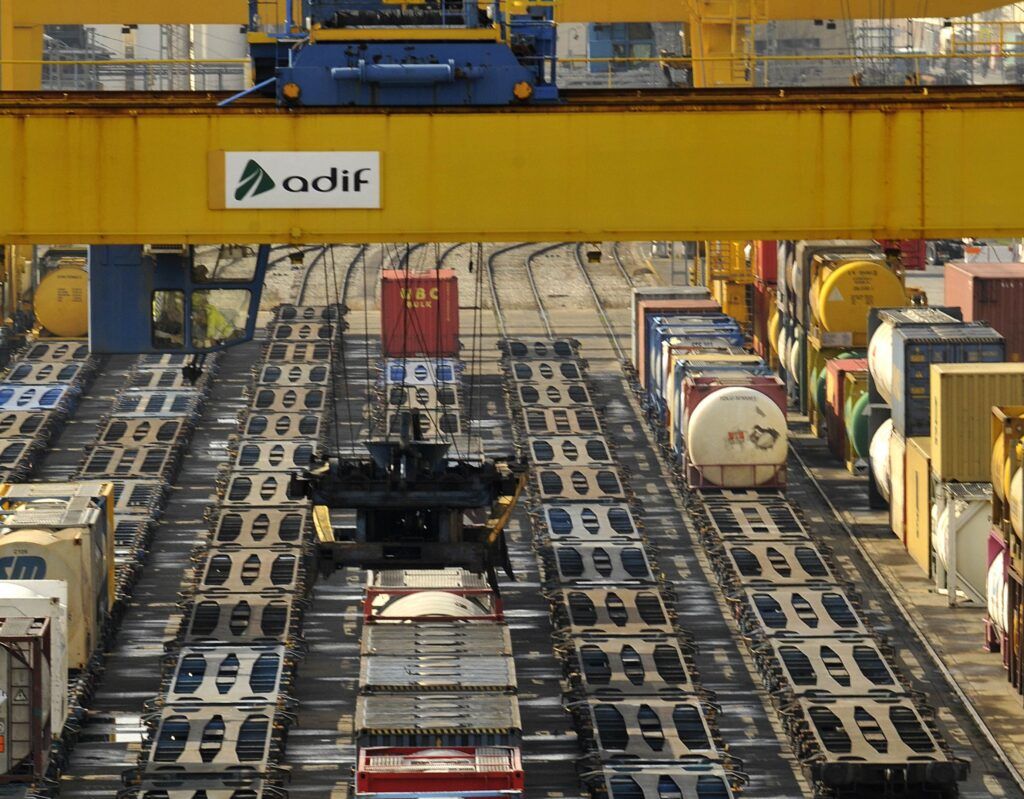

If we return to Barcelona, Alaminos explains that the Port Authority of Barcelona (APB) participates with a contribution of 200M€ in the project of the New Railway Accesses to the Port of Barcelona, which ADIF has undertaken, and which has a global budget of more than 700 million euros.

Likewise, during this year, the APB has set up a new company with ADIF, Train-Port of Barcelona, which will centralize in a coordinated manner all rail traffic in the port area of Barcelona and will develop, once available, the new accesses and the construction of the new Intermodal Terminal of the Port of Barcelona, with an estimated budget of €25M.

Investment challenges

The estimated size of the investment portfolio is about €80 billion until 2034. This amount excludes investments by private companies and is higher than the 2018 estimate.

"Although project development processes are long, the report shows that they are now more mature than in 2018, but there are two major barriers, not so much social but financial," clarifies de Langen.

The first is that many of these projects cannot be financed exclusively by the port authorities because they do not have sufficient return on investment. And the second, de Langen points out, is that over the past five years construction prices have risen by 30% or so, which increases the financial pressure to execute them.

"This is problematic because the total investment required amounts to 80 billion, but the investment capacity of the total port managers is not sufficient, as they are not able to self-generate this figure," he warns.

This is the message that ESPO wants to send: the ports are at a stage where investments and the capacity to carry them out are lacking, which is why a large part of them have not been carried out.

Alaminos explains that the Spanish port system is financially self-sufficient, as it does not depend on the general state budget.

"The APB, like the rest of the Port Authorities, must generate sufficient resources to cover its ordinary operating expenses and its growth, that is, its investments. To guarantee this, the Spanish port system has a solidarity mechanism based on which all ports make contributions to financially support those Port Authorities that are financially loss-making," she shared.

Alaminos goes on to explain that "when the resources we generate are not sufficient to cover our investment needs, we resort to bank borrowing like any other commercial entity. Due to the type of actions we finance, we are used to financing through loans from the European Investment Bank, in addition to opting for most of the investment financing programs through subsidies promoted by the European Union", she describes.

So what is the solution?

De Langen explains that among the ports there are high expectations for European and also state funding.

"In Europe there has been a lot of investment in ports, in all kinds of investments. But possibly the gap between expectations and instruments is bigger in the member states," he notes.

"In Europe we tend to dialogue until we reach consensus in decision making. Studies on financing such as this one have value. At the ESPO conference in Paris there were a couple of very noteworthy contributions in line with the current geopolitical tensions that are causing Europe to move towards a scenario of strategic autonomy," he reveals.

The future of port investments

De Langen believes that it is also necessary to invest in port logistics-industrial capacity. The problem, he points out, is the lack of land. "I think we are moving towards a spatial economy in which industrial port 'islands', literal or metaphorical, are an interesting model. I don't know if we need more port capacity for external business, but we clearly need land for logistics and industrial activities," he says.

He recalls the case of the port of Rotterdam, when a debate was generated about its expansion and which, in the end, has fallen short.

Returning to the issue of funding, the study notes and concludes that EU funding instruments should be accessible, and project applications should be based on their added value in contributing to the achievement of the objectives set, even if national co-financing is not available.

The rules and conditions for submitting projects for funding should be streamlined, simplified and adapted to the reality of European ports.