Arctic routes: Russia, China and Korea accelerate

Arctic ice melt transforms maritime transport geopolitics: analysis of Russia, China and South Korea's growing strategic interest in developing commercial routes through the North Pole

Jordi Torrent is the Strategy Manager at Port de Barcelona.

On April 4, 2019, we published on Pier Next New Routes in the Arctic: Breaking the Ice of Navigation through the North Pole. Probably a scoop, at least in Spain, about the incipient development of maritime freight transport through the Arctic.

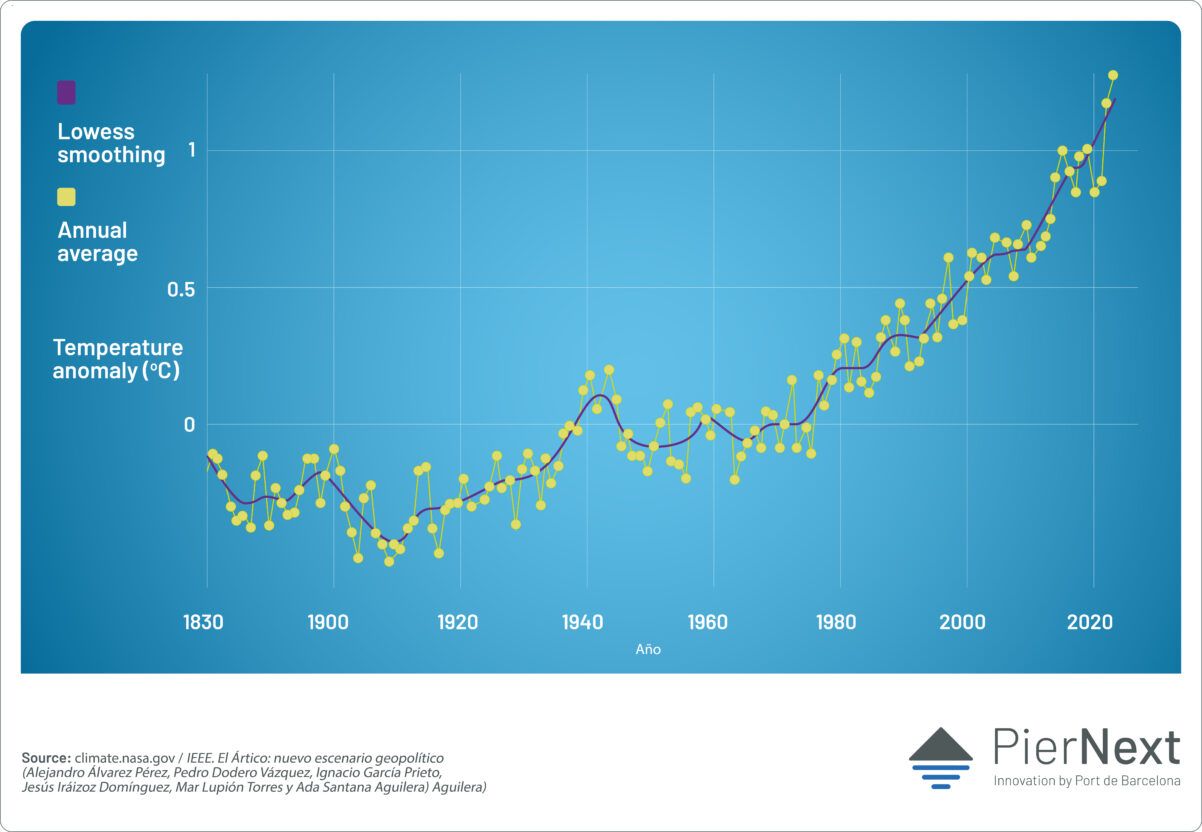

Back then, the development of Arctic routes, especially the Northeast (also known as Northern) route connecting Europe with Asia along the Siberian coast, only seemed to genuinely interest Russia and, to a lesser extent, China. All medium and large powers were perfectly aware of the rising temperatures in the region (see chart 1) as a consequence of climate change.

![]()

![]()

![]()

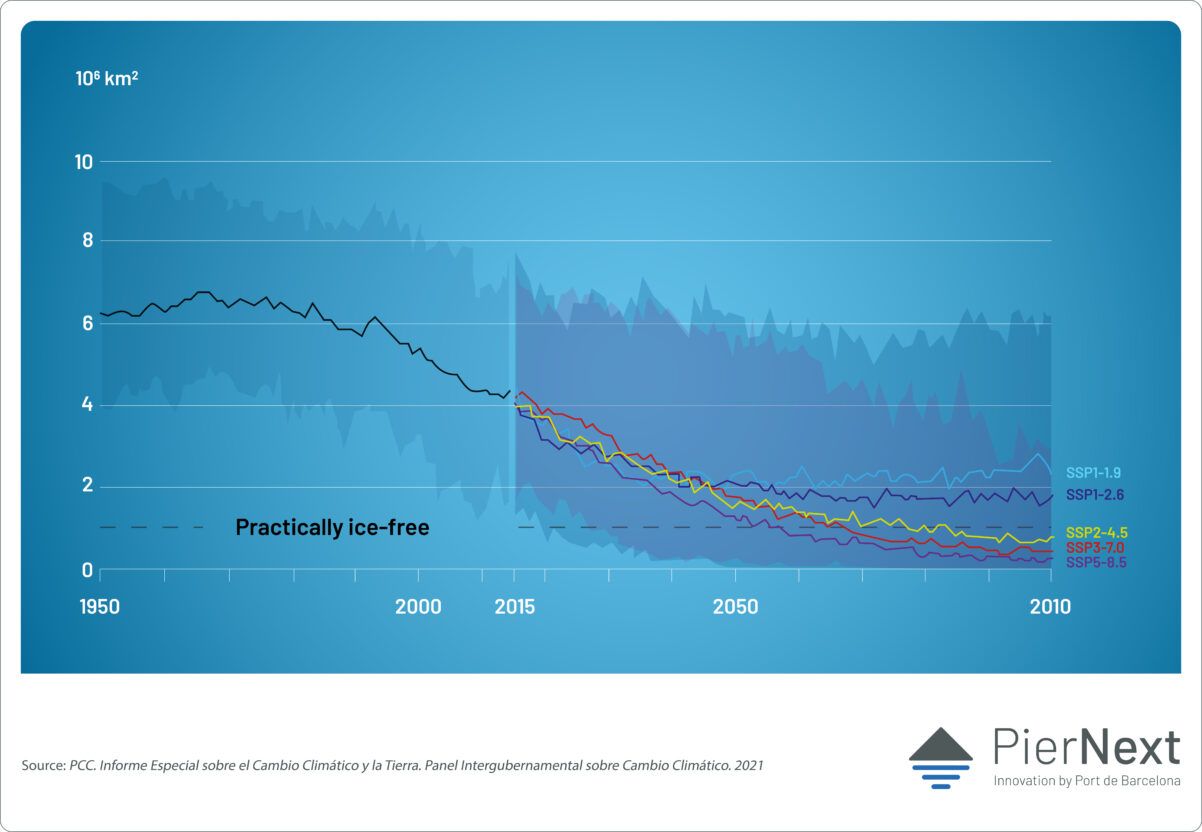

A temperature evolution that was intensifying ice melt (see chart 2), which would soon allow relatively easy navigation. However, Western countries, using the sacrosanct protection of the Arctic as an excuse and focused on fighting climate change, refused to even consider exploring its development.

Also in 2019, the first College of Commissioners began, presided over by Ursula von der Leyen, which would make fighting climate change practically its sole priority. Arctic exploitation was taboo in the EU. European-based shipowners, MSC, Maersk and CMA CGM, rejected its development due to operational complications and high costs, and because of the reputational damage they would suffer by becoming promoters of Arctic routes.

And the taboo of Arctic exploitation ended

Trump was the first Western leader to break the taboo without hesitation. During his first term he had shown vague interest in acquiring or conquering Greenland. On August 18, 2019, the American president said he was analyzing the possibility of acquiring Greenland but that it was not one of his priorities. His main motivations were military and economic. Competing with Russia and China in exploiting Arctic natural resources and protecting his territory from a potential Russian attack, since Russia's nuclear arsenal closest to major American cities is located in the Russian Arctic. At the time, his proposal went no further and was dismissed with indifference by naive Europeans, even by Denmark.

A year and a half earlier, on January 18, 2018, China had announced its Arctic policy. The Asian giant proclaimed itself a "near-Arctic" state and prepared to decisively promote the Polar Silk Road. It was not improvised. China had spent years courting member states of the now moribund Arctic Council to achieve observer status. It had succeeded in 2013.

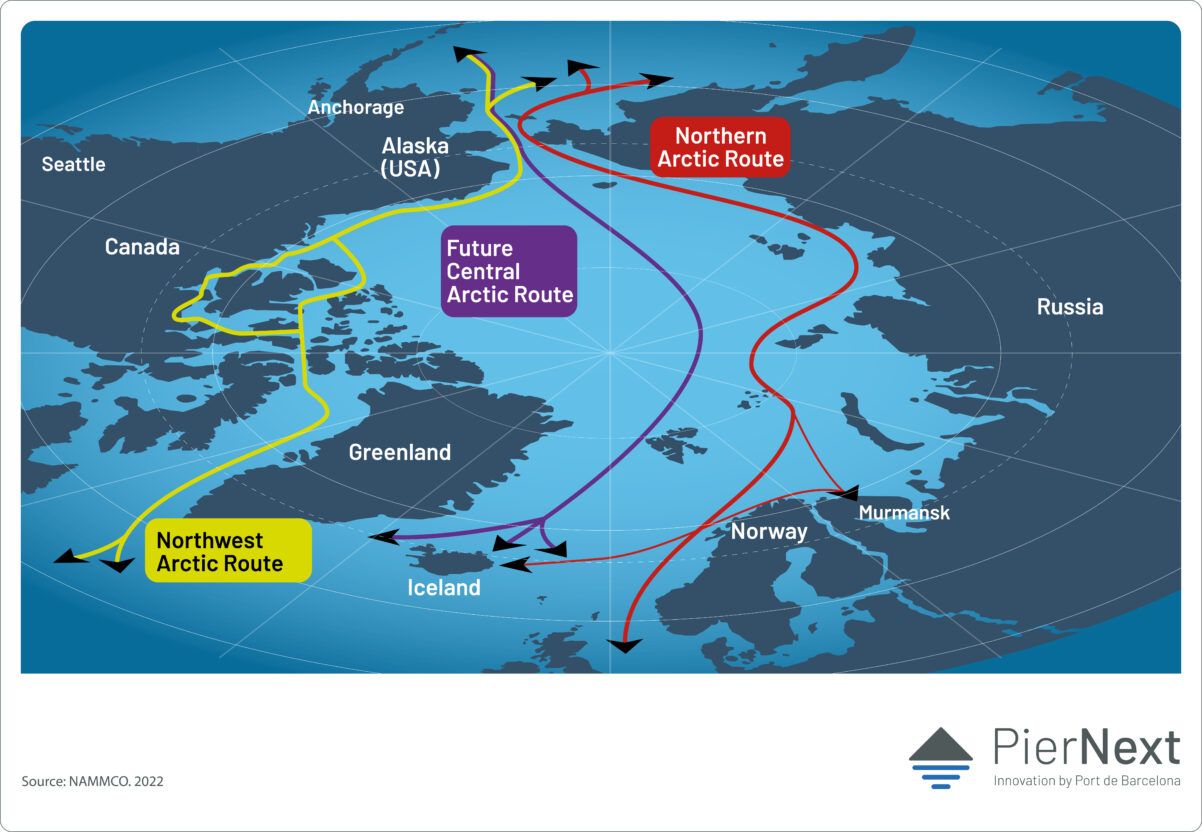

- The Russian invasion of Ukraine, launched in February 2022 by Vladimir Putin, represented an unexpected and sudden boost for the development of the Northern or Northeast Arctic route (see map 1) between Russia and Europe and Far Eastern countries, most especially China. Pressed by Western sanctions, the Russian president, who had always considered Arctic exploitation one of Russia's priorities for the 21st century, shifted into high gear with invaluable Chinese collaboration.

The old and cherished dream of Russian tsars and general secretaries of the USSR's communist party, to turn Russia into a global maritime power, took shape for the first time. The bottleneck of the Turkish straits of the Bosphorus and Dardanelles, cause of atrocious military conflicts (including the Crimean War in the 19th century and World War I in the 20th), could be overcome for the first time by Russia.

Russia intensified the extraction of fossil fuels in the Arctic (especially around the Yamal Peninsula) and their export to the Far East and, hand in hand with China, accelerated investment in ports, icebreakers, maritime rescue, cartography, navigation systems and equipment to facilitate military and merchant navigation.

Intensification of Arctic navigation

The routes and ships traversing the Northeast Arctic route have been gradually growing since then thanks to the intensification of climate change and Sino-Russian investment in merchant navigation. There has been a shift from exclusive use of the Northeast route by LNG carriers and oil tankers to greater diversification. Little by little and still in dribs and drabs, use of the route has been increasing in the container ship sector.

The war in Gaza and Houthi attacks on merchant shipping in solidarity with the Palestinians of Gaza, filled Russia, China and other powers with even more reasons about the strategic importance of the Northeast route. Ships connecting Asia and Europe had to detour via the Cape of Good Hope route, increasing navigation time between the two continents by one to two weeks.

The Northeast Arctic route allows substantially shortening the journey between Shanghai and Rotterdam compared to the traditional route through the Suez Canal. Also with many other destinations, including American ports on the Atlantic and Pacific coasts (see table 1).

Table 1. Route distance from the port of Shanghai to different destinations

| Country | Representative port | Current route | Current route (km) | Arctic route (km) |

| Canada | Vancouver | Pacific | 14,654 | 11,413 |

| Halifax | Pacific | 14,654 | 11,413 | |

| USA | Los Angeles | Pacific | 15,012 | 12,393 |

| New York | Atlantic | 15,012 | 12,393 | |

| Norway | Bergen | Suez | 20,217 | 12,730 |

| Denmark | Copenhagen | Suez | 20,157 | 13,870 |

| UK | London | Suez | 19,302 | 13,750 |

| France | Le Havre | Suez | 19,032 | 13,990 |

| Germany | Hamburg | Suez | 19,849 | 13,580 |

| Finland | Helsinki | Suez | 21,011 | 15,540 |

| Netherlands | Rotterdam | Suez | 19,416 | 14,503 |

| Sweden | Gothenburg | Suez | 20,201 | 14,231 |

| Belgium | Antwerp | Suez | 19,378 | 14,533 |

| Iceland | Reykjavik | Suez | 20,431 | 13,313 |

New incentives for arctic route development in highly turbulent times

The savings in time and costs (especially fuel) are even greater when compared to the longer route via the Cape of Good Hope. In the Shanghai-Rotterdam relationship, from nearly 20,000 km distance via the Suez Canal, it increases to nearly 30,000 km via the Cape of Good Hope, compared to approximately 15,000 km that must be traveled via the Arctic route.

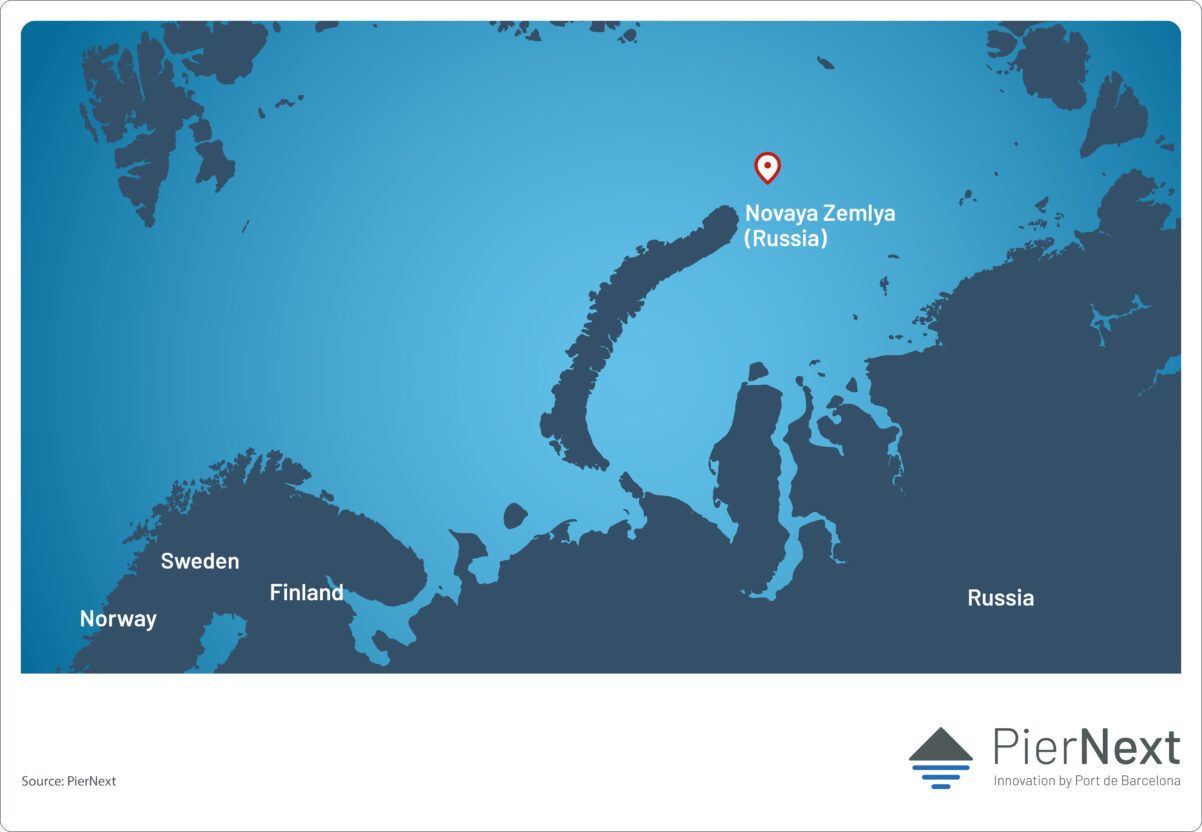

In 2024 and 2025, during the months of September and October, when Arctic navigation is easier due to substantial ice reduction, important milestones were achieved in the development of the Northeast route. In 2024, for the first time, two Chinese container ships crossed near Novaya Zemlya island (see map 2). They were ships of respectable dimensions (around 5,000 TEU capacity) connecting Chinese and Russian ports in the Baltic Sea. In October 2025, for the first time a container ship that had departed from China called at a British port after crossing the Arctic.

Korea, also in Arctic fever

Korea has been the latest power to join Arctic fever. The country's new president, Lee Jae-myung, from the electoral campaign and inauguration on June 5, 2025, made the Arctic one of his priorities. The government of the most dynamic country on the planet today considers the Arctic route a great opportunity to increase the competitiveness of its external sector and turn the port of Busan, the large intercontinental port closest to the Arctic, into a polar Singapore of the 21st century.

Palli, palli (fast, fast) as they say in Korean business jargon, in just a few months the government has moved the ministry of oceans and fisheries (the equivalent of a Ministry of Transport) from Seoul to Busan. Overnight, 3,000 civil servants had to change residence.

The president has also announced that in 2026 the first Korean container ships will navigate through the Arctic, for which he will need to reach some type of agreement with Russia, with whom he is at odds over his support for the North Korean government. It seems difficult, but perhaps not so much if we consider that many of the ice-class vessels transporting Russian LNG from Yamal to the Far East have been built in Korean shipyards.

We will see what surprises this 2026 holds for the relationship between the Republic of Korea (not to be confused with North Korea) and Russia. Trump's erratic foreign policy will probably also help a collaboration that seemed unthinkable until very recently.

The Mediterranean's role in the Arctic route

The Mediterranean, meanwhile, observes Arctic development from afar. While it is true that the route between any point in Asia and the Mediterranean is almost always shorter via the Indian Ocean, Red Sea and Suez Canal than via the Arctic (if compared with the Cape of Good Hope route, it's another matter, since routes starting approximately from the northern half of Vietnam toward the Mediterranean are shorter via the Arctic than via the Cape of Good Hope), the risk for Mediterranean ports that the complete opening of the Northeast route to merchant navigation in competitive operational and commercial conditions would imply should not be underestimated.

- When this happens (the question is no longer if it will happen, but when) it will do so for long periods of time in conditions similar to those of other routes through the Indian, Pacific and Atlantic oceans. That is, with acceptable insurance premiums, without needing to be preceded by icebreakers, etc

- It will be then when many shipowners will be tempted to serve the hinterland of Mediterranean ports through those of northern Europe. Merchant ships that would load and unload in Rotterdam, Antwerp, Hamburg, etc. goods originating and destined for Asian countries in the Far East and that would be collected and distributed by land throughout the European continent. These same ships could take advantage of the Arctic route to also connect the Far East with the US East Coast and even with the Gulf of Mexico.

Many years still remain before this becomes a real alternative for several months a year (according to most analysts, between one or two decades if Atlantic currents are not altered beforehand, which could jeopardize the development of the Northeast Arctic route), but when it happens, it is almost inevitable that exporters and importers, shipowners and logistics operators will seriously consider this possibility.

Fortunately for Mediterranean ports, there are two factors that will limit the development of maritime freight services via the Northeast Arctic route:

- The first is the absence of consumption and production centers along the long Russian Siberian coast. Most major maritime freight services (containers, cars, etc.) need to call at various ports along their journey, from origin to destination, to make routes profitable and take advantage of the economies of scale that the gigantism of large merchant vessels allows.

- The second is the forecast that world foreign trade growth will move to lower latitudes in coming decades (toward the Indian subcontinent, Southeast Asia, Gulf of Guinea, etc.) at greater distance therefore from the Arctic route and closer to those crossing the Indian Ocean.