The decarbonization of road freight transport: technology and regulations

The transport sector is in a transition phase due to the commitment to decarbonizing the industry. This article aims to analyze the future of the road freight transport decarbonization and how to balance regulation and technological innovation.

Matteo Boschian Cuch is a researcher at CENIT and PhD student in mobility and sustainable transport at the Port of Barcelona.

The transport sector is responsible for 25% of greenhouse gas (GHG) emissions in Europe, with road transport accounting for 72% of these emissions in 2019. Among road transport, heavy-duty vehicles—including trucks and buses— are responsible for 27% of these road transport emissions.

Regarding freight transport, the road plays a central role, as road modal share has remained steady at around 75% over the past decade. Ports serve as key nodes for freight transport in Europe, acting as crucial hubs where trucks transfer goods between wharfs and the hinterland. For this reason, ports play an important role in the decarbonization of the sector by improving the quality and availability of intermodal transport options and expanding alternative fuel stations for refueling and charging new-generation road vehicles. In any case, the future outlook for inland transport remains uncertain.

On the “Sustainable and Smart Mobility Strategy”, European Commission stated that 75% of the inland freight carried by road should be shifted to rail and inland waterways.

The European Union has invested approximately €32 billion in railway infrastructure and €1,1 billion in intermodal freight transport-related projects since 2014 through the Connecting Europe Facility (CEF) mechanism. In addition, through the Recovery and Resilience Facility fund, more than €25,5 billion has been allocated to projects that foster intermodality. However, despite this huge EU investment in the, rail share has remained stuck at around 17% (Eurostat – 2022).

This modal share may be worse in the future. The introduction of zero-emission trucks could negate rail’s environmental advantage while maintaining road transport’s flexibility and door-to-door service. On the other side, the growing shortage of truck drivers in Europe complicates predictions for the future. This trend favors rail transport, as a single train can transport the equivalent of what 30/35 truck drivers would carry on long-haul routes. Additionally, trains are more energy-efficient than trucks due to lower rolling resistance, which is a relevant advantage to achieve the energy independence of the countries, especially in this unstable political level.

Probably, the ideal solution lies in a combination of different transport modes: trucks should handle first- and last-mile deliveries, while rail, inland waterways and short sea shipping should be prioritized for long-distance transport wherever possible.

Regulatory framework

The European Union has established a strong regulatory framework to achieve its commitment to Net Zero emissions by 2050. As is already known, the EU Emissions Trading System (EU-ETS) is a mechanism that requires polluters to pay for their greenhouse gas (GHG) emissions. In the transport sector, both aviation and the maritime industry are already required to calculate and pay for their emissions.

Companies under the EU ETS must surrender allowances for their greenhouse gas emissions. One allowance permits the emission of one ton of CO₂ or its equivalent. Those allowances can be obtained through auctions or traded on the secondary market. Auctions are held daily at the European Energy Exchange (EEX).

However, road transport—the main contributor—is not included. For this reason, the 2023 revision of the ETS Directive introduced a new emissions trading system: ETS2.

ETS2 aims to cover emissions from buildings, small industries not covered by the existing mechanism, and, finally, road transport. Since it would be impossible to monitor and report "downstream" emissions at the individual citizen level, applying the current ETS system to road transport would create an overly complex bureaucratic structure. To address this, ETS2 regulates "upstream" emissions instead, targeting the entities that commercialize fuels.

ETS2 will become fully operational in 2027, with an initial phase during which the regulation will be applied under more flexible conditions. During the first years if the price of the allowance exceeds the 45€ (2020 price) or it increase too quick, new allowances will be emitted for stabilizing the market. Considering that a diesel heavy-duty vehicle emits 0.76 kg of CO2 per kilometre, and using a carbon allowance price of 45€, the extra cost due to ETS2 for a 500 km trip would be approximately 17€ (based on 2020 prices).

The implementation of this new regulation could help rebalance the transport sector, as currently only the maritime and aviation sectors are required to pay into the ETS. Maritime transport was introduced into the ETS system in 2024, motorways of the sea could be impacted by increased costs, which may lead to a modal shift back to road transport that have an opposite environmental effect, as ferries are more sustainable intermodal system than road.

Additionally, the new Directive 2024/1610 for the freight transport vehicles producers been published in 2024 to regulate CO₂ emissions from new heavy-duty vehicles.

On the other hand, regarding local pollution, the European Council approved the new Euro 7 regulations last year. Compared to the previous Euro 6 regulations for light vehicles and Euro VI for heavy vehicles, the Euro 7 regulations apply to both categories. Moreover, it introduces additional limits on pollution caused by brake and tire abrasion, extend vehicle lifetime, and, for the first time, include regulations on the durability of batteries in battery-electric vehicles (BEVs).

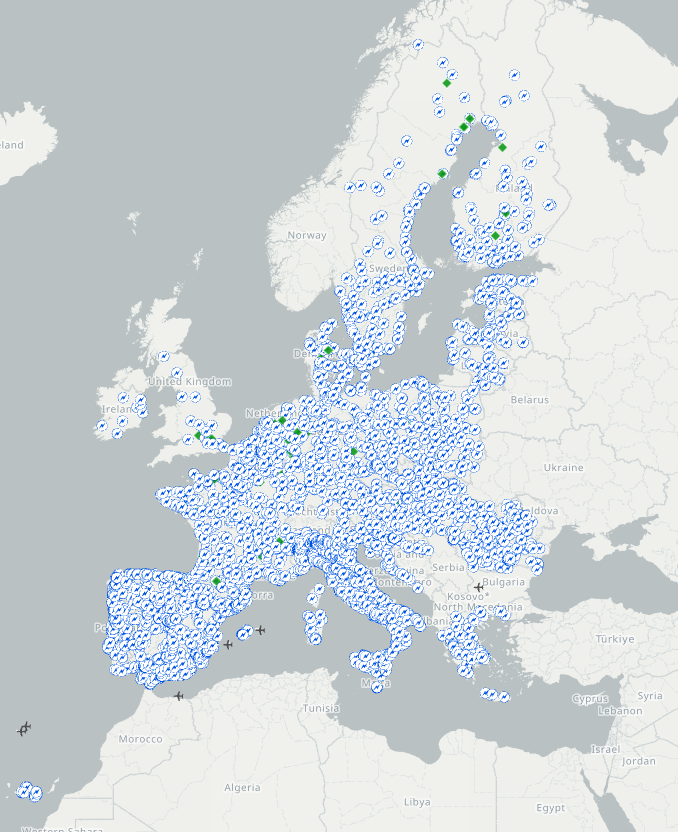

Finally, at the infrastructure level, the new TEN-T Regulation 2024/1679 mandates that all intermodal nodes must have charging points for alternative fuels. Moreover, 422 million € has been invested through the Alternative Fuel Infrastructure Facility (AFIF) funding instrument for the realisation of 2.500 electric charging point for light-duty vehicles, 2.400 for the heavy-duty vehicles, 35 hydrogen refuelling stations for all vehicles and other initiatives in ports and airports. The objective is to comply with the Regulation 2023/1804 for the deployment of alternative fuels infrastructure (AFIR).

These measures will help to address one of the main drawbacks of alternative fuels—the lack of charging infrastructure within the transport network—making their adoption more feasible and widespread.

New trucks: market trends

Looking at European market results published by Automobile Manufacturers’ Association (ACEA), new trucks registered in 2024 are 6.3% less than the previous year. The market is not diversified indeed the 96 % of new heavy-duty trucks are propelled by diesel; the remaining are a mix of electric and gas propelled vehicles. For what concerns the smaller vehicles (between 3.5 and 16 tons) the electric vehicles share increases to 7%, maintaining however the predominance of the diesel vehicles. On the other hand, looking at the passenger sector, new diesel bus registrations are limited to 63% in 2024, with electric buses accounting for 18.5%.

Those number show that the road freight transport still largely relies on diesel vehicles, especially for heavy-duty trucks used for long-haul transport. In contrast, electric vans and smaller trucks used in local distribution, such as last-mile e-commerce deliveries, could be a viable alternative.

Looking at European statistics, in the graphic below it is possible to notice the number of operations performed and the tons-kilometers transported in 2023, for every distance class. The 6% of the operations are longer than 500 km, representing the 43% of the tons-kilometers transported. These operations usually are performed by heavy-duty vehicles, for which it is more difficult to find an alternative to diesel. In fact, for the biggest European truck producers, the average maximum range is 500 km for battery electric vehicles.

However, battery-electric vehicles are not the only alternative to diesel trucks on the market. Indeed, there are biofuels or natural gas (CNG or LNG) that can provide a similar range to conventional engines. Additionally, green hydrogen fuel-cell (FC) trucks could be used for medium- and long-haul transport. The main issue, however, is that they are not completely on the European market, whereas in the USA, a few models are already available.

To conclude, the expansion of these alternative vehicles in the European fleet should be accompanied by substantial investment in developing a widespread recharging and refueling network across Europe.

Alternative fuels technologies

As previously observed, diesel trucks still dominate the market in terms of engine type, but the future is expected to comprise a mix of different solutions.

Alternative fuels can come from various sources, such as synthetic fuels (e-fuels) and biofuels. Both can replace fossil fuels without requiring changes to the existing infrastructure or engine modifications. However, they are not yet widely used due to limited production and high costs.

- Regarding biofuels, some are used blended with fossil fuels, while Hydrotreated Vegetable Oil (HVO) can fully replace diesel. HVO is a promising second-generation biofuel; however, its production cost is higher, and it can cause environmental issues, such as deforestation, due to land use for producing feedstock. While HVO can help mitigate climate change by reducing carbon emissions, it still contributes to local pollution.

- Another alternative is LNG (Liquefied Natural Gas), which is cheaper than diesel, reduces GHG emissions and local pollutants like NOx and PM, and is suitable for long-haul trucks. However, LNG refuelling infrastructure is not yet widespread in Europe, and LNG is still a fossil fuel. A more sustainable solution could be bio-LNG, which can gradually replace fossil LNG over time.

- Finally, there are electric vehicles and hydrogen vehicles that can address the issues related to GHG emissions, and they have net-zero local pollution emissions generated by combustion. However, their initial cost is still higher, and the charging/refuelling infrastructure is still not developed in Europe, with hydrogen infrastructure being particularly complex. Moreover, battery electric vehicles (BEVs) reduce maintenance costs compared to combustion engines and reduce noise pollution. However, from a technical perspective, the batteries required reduce the vehicle's payload, and BEVs have a limited range, which makes them less suitable for long-haul trips—especially considering the charging time required. On the other hand, hydrogen vehicles allow longer distances.

In summary, various alternatives are available in the market or under investigation for the future. Electric trucks will likely be a strong solution for urban or regional distribution, while other technologies may be more suitable for long-haul transport. In the short term, HVO or LNG vehicles are the most promising solutions for decarbonizing long-haul trips, while hydrogen could become a viable option in the longer term.

In conclusion, various opportunities exist for the decarbonization of road freight transport—some are already available on the market, while others are still under development. From a technical standpoint, solutions are emerging, but the key obstacle remains their widespread commercialization and adoption by end users. However, diesel trucks continue to dominate due to high costs, infrastructure limitations, and other challenges discussed earlier

A crucial question remains: will the regulations and technological advancements be enough to decarbonize the transport sector and achieve the target set by the Green Deal? While their impact is yet to be seen, one thing is certain—the transition will require strategic investments, and close collaboration between policymakers, industries, and consumers.

The road ahead is long, but with the right commitment, the shift to a greener transport sector is within reach.