Container ships are an important part of the global logistics chain and, therefore, vessel size and efficiency must increase to improve economies of scale.

Container ships are an important part of the global logistics chain and, therefore, vessel size and efficiency must increase to improve economies of scale.

Container-ship size: What dimensions can we expect to see?

Since containers were first created in the 1950s, ships have grown exponentially in size. Container ships are an important part of the global logistics chain and, therefore, vessel size and efficiency must increase to improve economies of scale.

Javier Garrido is a researcher at the Center of Innovation and Transport (CENIT) and PhD student at Port de Barcelona.

Container ships are an important part of the global logistics chain and, therefore, vessel size and efficiency must increase to improve economies of scale.

Container ships are an important part of the global logistics chain and, therefore, vessel size and efficiency must increase to improve economies of scale.

Over the past two decades, the capacity of container ships has tripled and shipyards now have vessels that can hold 23,000 TEUs. Despite exponential growth in this sector, some question whether it may top out, as happened with bulk cargo vessels or, recently, with the Airbus 380. Therefore, while the world is waiting for the next generation of mega container ships, we’ll try to answer the following question: Are we going to see a Post Suezmax vessel in the coming decades?

First of all, it is important to understand why there have been six waves of substantial changes to container ships, each one represented by a new generation of vessels.

The first generation was basically modified bulk vessels with capacity for up to 1,000 TEUs. Things evolved rapidly from there, however. Ships continued to upsize capacity and dimensions until they could no longer fit through the Panama Canal, in 1985, with a capacity around 4,000 TEUs. These vessels, therefore, are known as the Panamax generation.

In 1988, the first ships were made with a width of more than 32.3 metres, launching the Post-Panamax generation of container ships. This led to infrastructure problems at most ports worldwide, as they had to invest in wider gantry cranes and dredge the ground to accommodate these vessels.

In the early 2000s, demand and volume continued to grow. From 2001 to 2006, growth in trade volume was three times higher than GDP growth, on average. Therefore, the top shipping lines, which started to form strategic alliances, saw the need for a new generation of container vessels. In 2006, with the introduction of Emma Mærsk, the first very large container ship (VLCS) went into service. Bigger container ships reduced the cost per TEU even further, which increased demand and therefore incentivised even larger ships.

This feedback loop came to an end when the financial crisis hit in 2008 and demand started to flag. However, the market power of alliances and the rise of emerging markets like China continued to push container-ship upsizing further, even though demand was not catching up. So, about 10 years later, ultra large container ships (ULCS) with capacities over 20,000 TEUs were introduced.

Nowadays, the biggest container ship in terms of capacity is the MSC Gülsün, with 23.756 TEUs, 400 metres in length, 61,5 metres in width and 16,5-metre draught. Even though capacity rose notably, the size of the newest container ships hasn’t changed that much in recent years.

Influencing factors that could lead to change in container-ship size

To understand which factors can lead to the development of a new generation of mega vessels we have to look at the influencing factors and interdependencies, which can be divided into six categories:

- Technology

- Sustainability

- Market

- Cost infrastructure

- Port infrastructure

- Sailing routes

The figure below shows various factors for each category and our guess as to whether they will lead to an increase or decrease in ship size.

Are we going to see a Post Suezmax vessel in the coming decades?

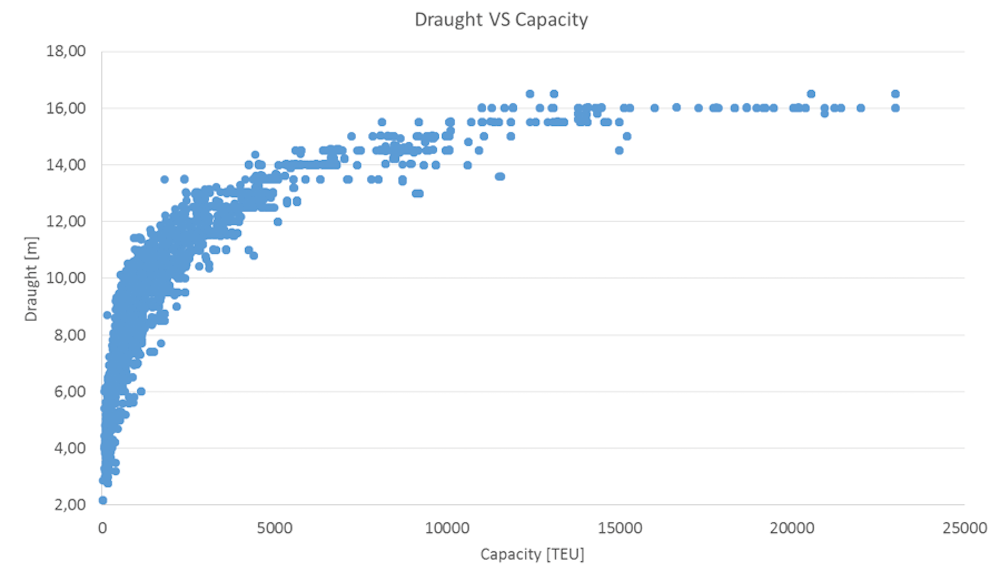

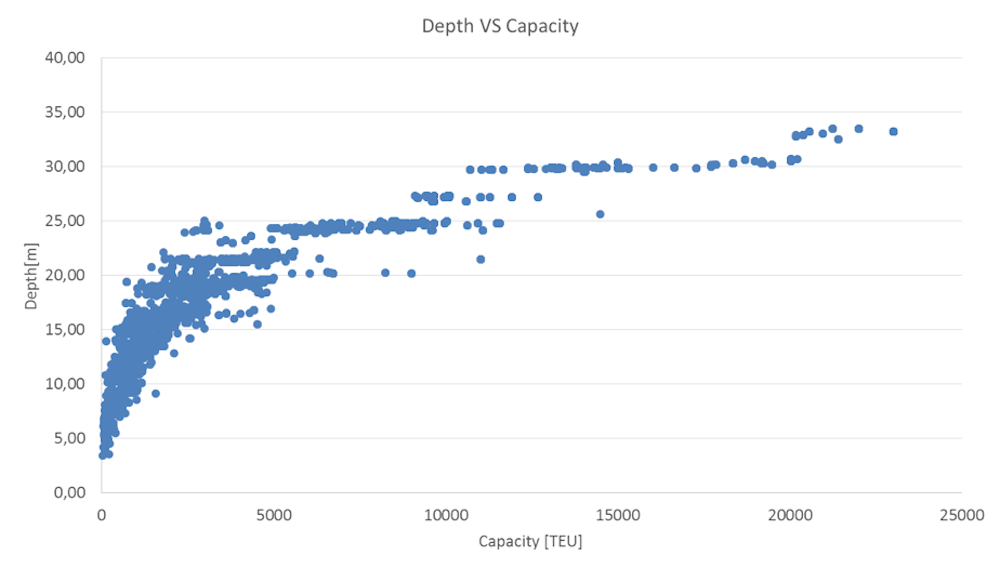

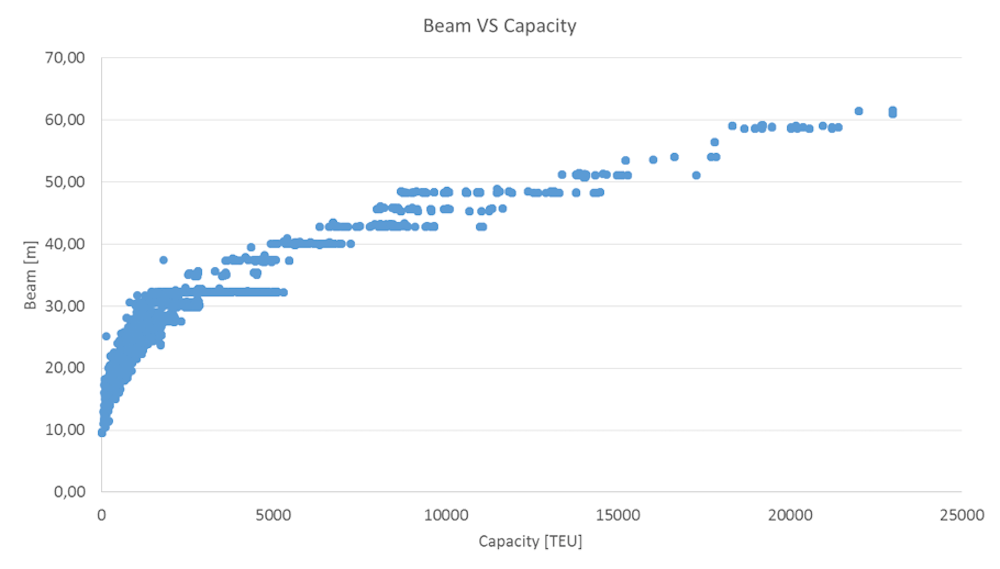

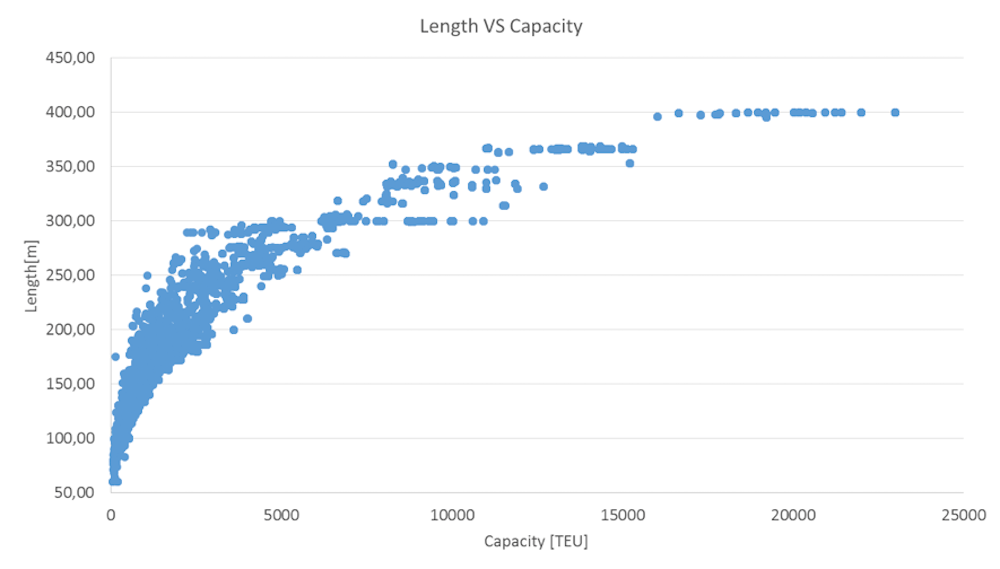

To predict further development, we have analysed the dimensions of past container ships, based on Lloyds Database. The following charts illustrate the length, beam, depth and draught in relation to capacity in TEUs. The container ships from the 2019 orderbook have been included in the figures.

Analysing the relationships between the dimensions of container ships and their capacity in TEUs, we can conclude the following trends:

- Draught does not significantly change after hitting the 12,000-TEU mark. In fact, it seems to stabilise around 16-16.5 metres.

- Depth seems to stabilise around 30 metres for vessels bigger than 12,000 TEUs, but for the latest ULCV with a capacity greater than 20,000 TEUs, it has increased to 35 metres, approximately.

- Length stabilises around 400 metres for vessels over 15,000 TEUs.

- Beam is the dimension showing the largest growth, proportionally.

- Beam, length and depth are clearly growing by intervals, based on the new rows of TEUs added in each direction.

- Increase in capacity for VLCS and ULCS is clearly related to the changes in length, depth and beam, but significantly the last one. Regarding draught, it is the least affected dimension in the new mega vessels.

Analysing all the graphics together, we can see that the dimensions are increasing with higher capacity. However, the gradient is decreasing for all, which means higher capacities are achieved without a substantial increase in vessel size. According to the latest vessel developments, the beam seems to be the dimension best able to accommodate extra TEU capacity compared to the other dimensions.

Once we have analysed the data for the past, we can extrapolate the results to the future. So, according to the figures, we can estimate that, if there is no significant change in the evolution of vessel size, a container ship with capacity of 30,000 TEUs would not exceed 17 metres in draught and the length would hardly reach the 425 metres. With regard to the beam, the trends show a possible increase in that dimension, so possibly they could reach 65 metres across the beam. Even though vessel size is growing, it is clear that the dimensions wouldn’t change that much in relation to capacity.

Summing up, the evolution of container ships is not finished. Based on data from the past, we can predict the dimensions of a potential container ship with capacity of 30,000 TEUs. However, any technological disruption could change this evolution substantially. We put these estimations in more context by analysing different influencing factors and dependencies. Any new generation of container ships would face a declining number of ports able to handle them. So, will ports be able to upgrade their infrastructures?

Another important factor to consider is that the limits in container-ship size seem much more limited by business strategy and canal dimensions than by technical constraints.

Environmental factors could be a significant driving force in the current climate crisis caused by global warming. Will ships be bigger and with more efficient engines to reduce the number of externalities per TEU? Will the pressure of ports and cities charging vessels based on emissions favour smaller container ships?