Definition of costs

This research includes 246 cruises out of a total of 350, and excludes those ships with no construction data available. Our team analyzes economies of scale using a specific model for cruise ships which includes all three costs mentioned above, considering the gross tonnage (GT) as the average unit cost.

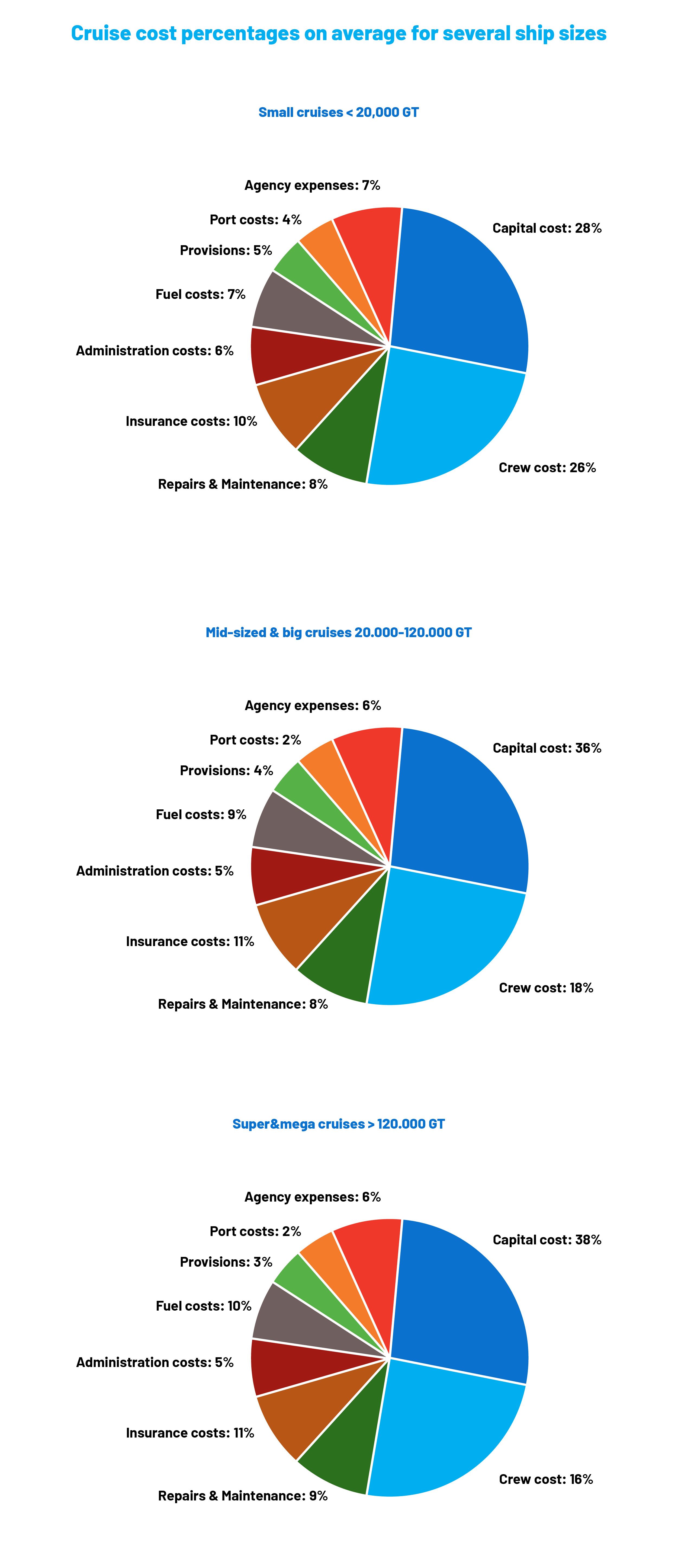

Capital costs refer to the costs of building the ship, plus interest. Findings show that building a cruise ship ranges from €350 million to €1.3 billion, much higher than other types of ships. For example, container ships cost between €53 million to €200 million.

Operating costs apply to the expenses related to the daily operation of the vessel, and includes crew costs, maintenance and repair, insurance, and administration costs. Our research has found out that crew costs are the highest component due to the large number of auxiliary personnel required, which multiply by 50 the complement of a general cargo vessel.

Finally, voyage costs involve costs for commercial use of the vessel. Includes fuel, provisions, port costs, agency expenses, and others. The main findings are that fuel costs are the most significant element, and at the same time, the most difficult to calculate due to its fluctuation. They also depend on the size and speed of the ship, the power of its engine, and the distance traveled. They are very sensitive to changes in speed, as five knots increase represents, for example, an extra cost between €35.000 and €75.000 per day.

Results of the research

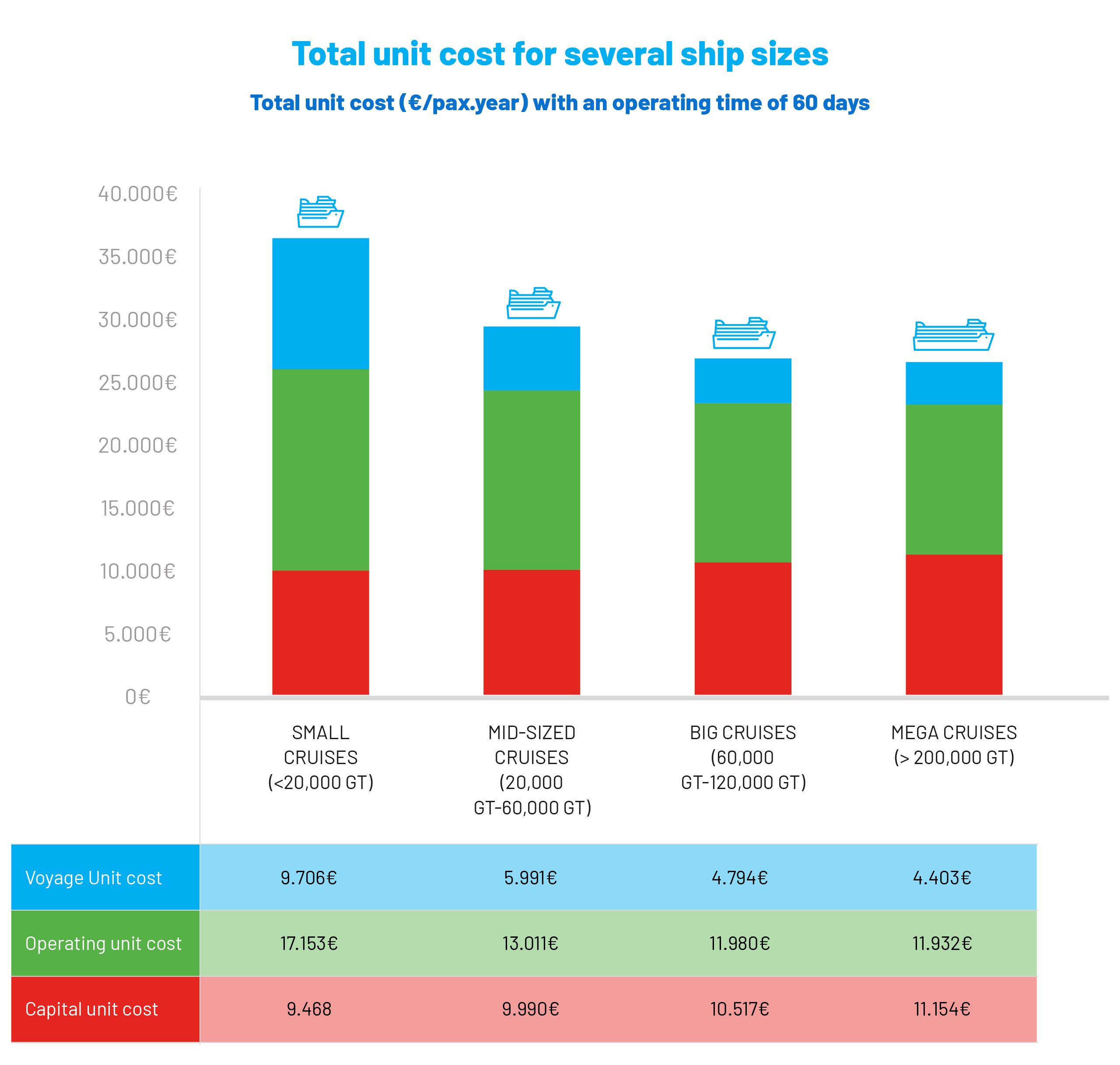

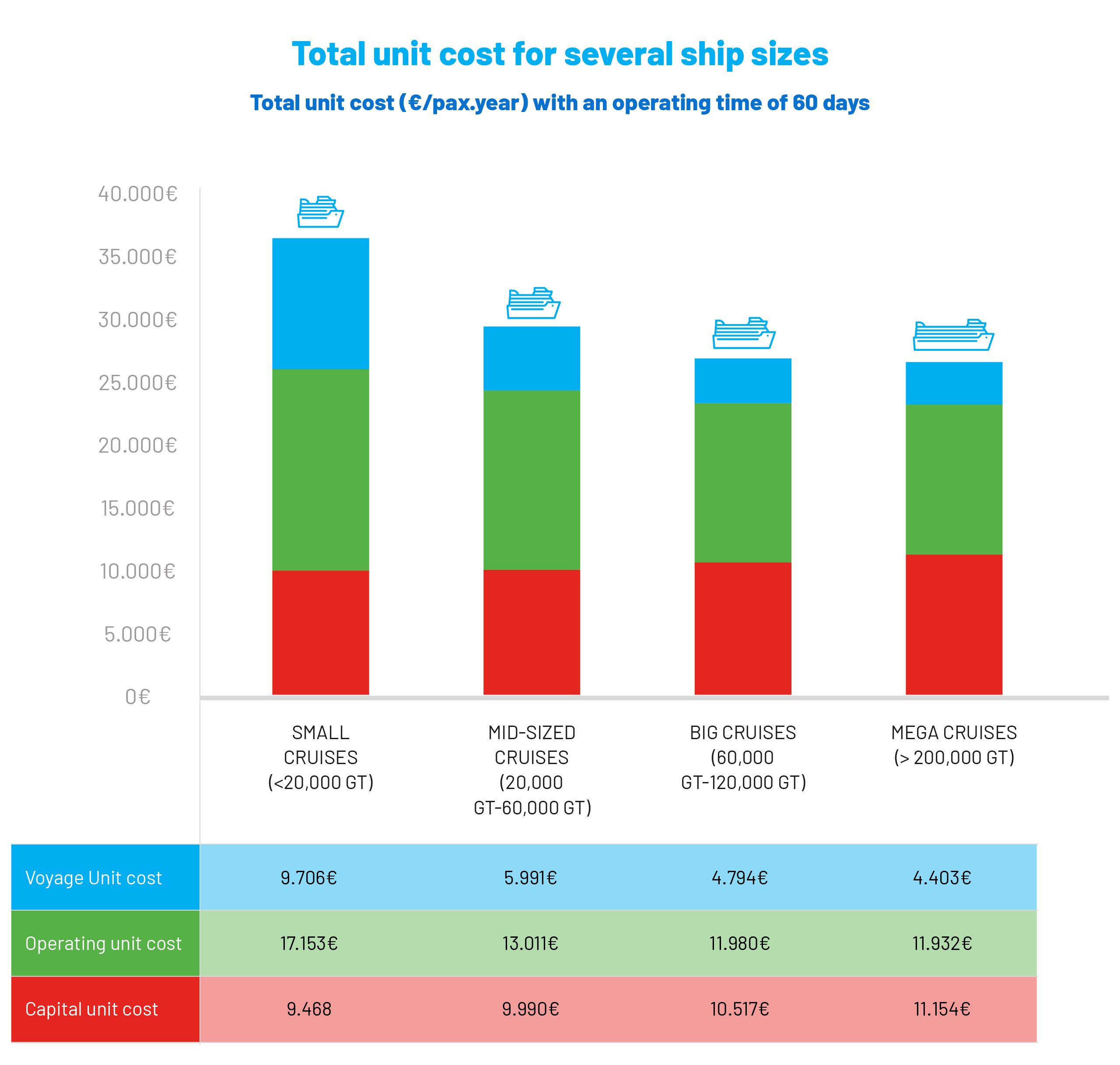

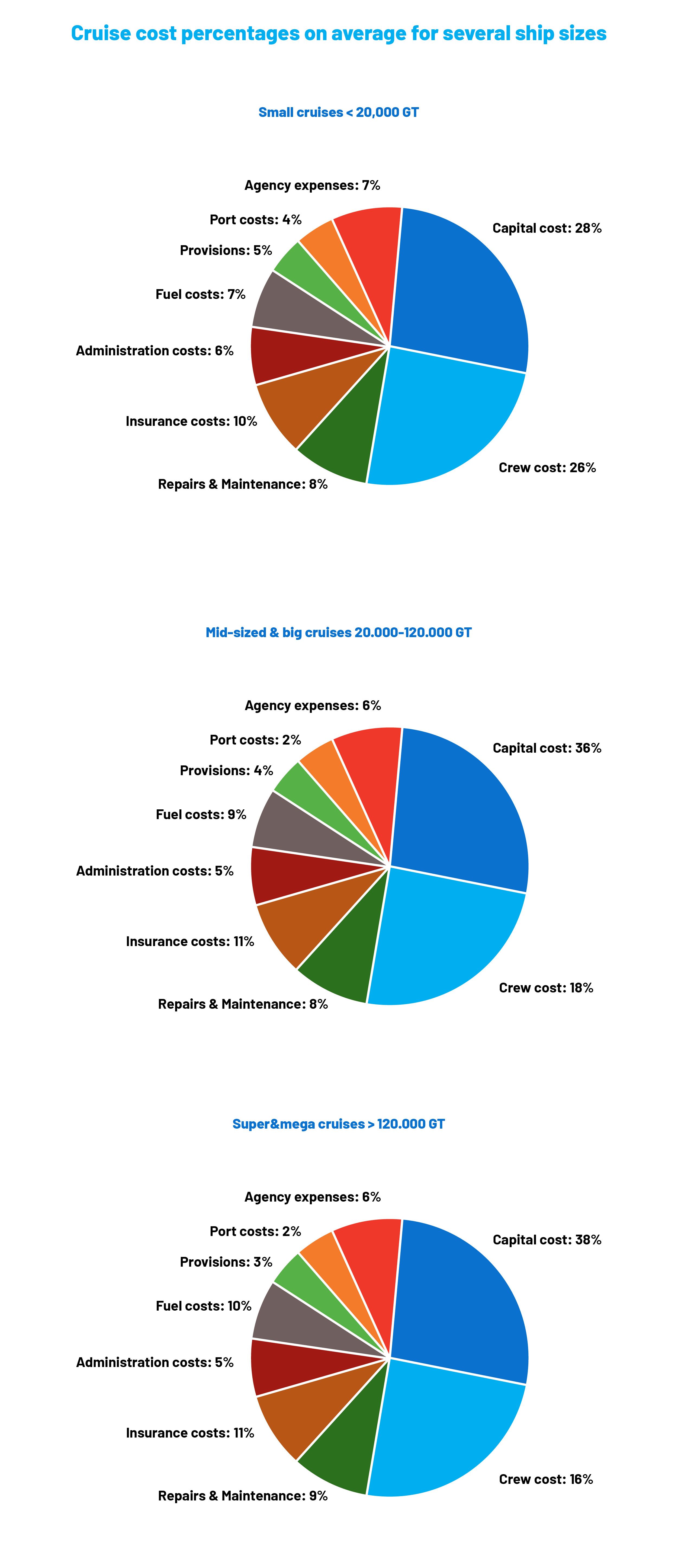

Since the beginning of the modern era, cruise ships have evolved to larger vessels. In this sense, cruise companies choose to build larger ships in order to achieve economies of scale, facilitate revenue capture, and expand passenger demand. This has an impact on cost structure, as the capital costs are between 28 and 38%; the operating costs between 41 and 50%; and the voyage costs between 21 and 22%. Here we present the cost structure as indicated for several ship sizes.

Regarding economies of scale, three main aspects can be pointed out, as seen on Figure 2: cruise ships over 120,000 GT don’t meet economies of scale and commissioning mega vessels is part of the cruise lines commercial strategies to maximize revenues rather than reducing costs. Lastly, according to the order book, it seems that demand for cruise ships beyond 227,700 GT will slow down, matching the study’s conclusions.

Regarding economies of scale, three main aspects can be pointed out, as seen on Figure 2: cruise ships over 120,000 GT don’t meet economies of scale and commissioning mega vessels is part of the cruise lines commercial strategies to maximize revenues rather than reducing costs. Lastly, according to the order book, it seems that demand for cruise ships beyond 227,700 GT will slow down, matching the study’s conclusions.

Next steps

COVID-19 creates a completely new scenario. The cruise industry has been severely damaged by the pandemic and its future is now very uncertain. In addition to the lack of revenue due to the absence of passengers, cruise lines have other problems to solve. Empty cruises are very expensive to maintain along with finding a place to dock. The situation is even worse on mega cruises.

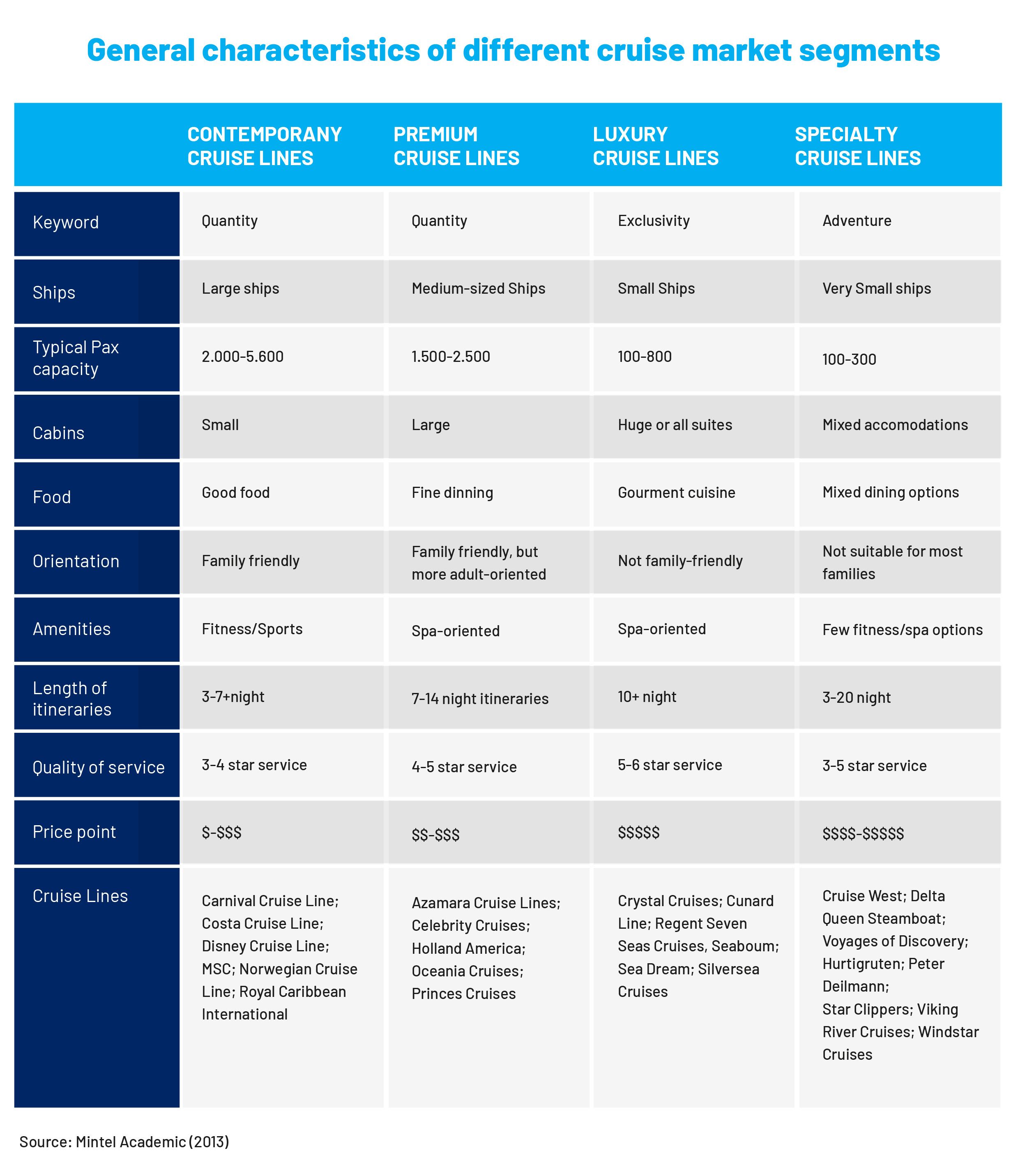

Looking into the future, new trends suggest that only smaller cruises and shorter voyages will operate. The reasons are lower costs and availability of ports where the cruise ships can call.

Currently, there are approximately 350 operative cruise ships worldwide with a great diversity in sizes and sectors. (Port of Barcelona)

Currently, there are approximately 350 operative cruise ships worldwide with a great diversity in sizes and sectors. (Port of Barcelona)

Currently, there are approximately 350 operative cruise ships worldwide with a great diversity in sizes and sectors. (Port of Barcelona)

Currently, there are approximately 350 operative cruise ships worldwide with a great diversity in sizes and sectors. (Port of Barcelona)

Regarding economies of scale, three main aspects can be pointed out, as seen on Figure 2: cruise ships over 120,000 GT don’t meet economies of scale and commissioning mega vessels is part of the cruise lines commercial strategies to maximize revenues rather than reducing costs. Lastly, according to the order book, it seems that demand for cruise ships beyond 227,700 GT will slow down, matching the study’s conclusions.

Regarding economies of scale, three main aspects can be pointed out, as seen on Figure 2: cruise ships over 120,000 GT don’t meet economies of scale and commissioning mega vessels is part of the cruise lines commercial strategies to maximize revenues rather than reducing costs. Lastly, according to the order book, it seems that demand for cruise ships beyond 227,700 GT will slow down, matching the study’s conclusions.