Ammonia, alternative fuel: the groundwork for a pioneering fleet

Although there are significant challenges to consolidating ammonia's presence as an alternative fuel in the maritime sector, creating a first pioneering fleet is already viable. To make it a reality, aspects such as regulation, technological innovation, crew training, and, above all, port adaptations come into play.

A FUEL TO BRING US CLOSER TO THE FUTURE

Ammonia with low greenhouse gas emissions (or, in the future, green or renewable ammonia) is considered a fuel that can contribute to the decarbonization of the maritime sector and to achieving the objectives of the Net-Zero Framework approved by the International Maritime Organization in April 2025. Behind this interest is the fact that ammonia does not contain carbon, so if it is produced with renewable electricity (green ammonia), it can be a practically CO₂-free fuel in use.

"Although it has lower energy density than fossil fuels, this is sufficient for maritime operations, unlike hydrogen," explains Maurici Hervas, Head of Energy Transition at the Port of Barcelona. "Another potential attraction is its use in fuel cells, which would enable the electrification of ships and facilitate certain synergies, mainly by helping to reduce the pollutants that would still be generated when burning ammonia, such as NOx. In addition, the fact that it has no carbon in its molecule eliminates the need for a biogenic or previously captured carbon feedstock from the atmosphere. This aspect gives ammonia a significant advantage over other fuels such as biodiesel, bio-LNG or green methanol," Hervas notes.

The report ‘Ammonia in Shipping: Tracing the emergence of a new fuel’ prepared by DNV, evaluates the current state of low-emission ammonia as a fuel for ships, taking into account ten barriers that hinder its implementation, among which building, supplying and operating a pioneering ammonia-powered fleet and establishing the necessary regulatory framework for greater expansion stand out.

However, the study emphasizes, it is not necessary to completely overcome each and every barrier to make a pioneering fleet a reality. Currently, and according to DNV, the development of different ammonia-powered engines is in its final stages and several ports are preparing for their safe supply. This implies "a significant advance compared to 2020, when such engines were only in the concept stage and there were no orders for new ammonia-capable units," the report states.

THE CHALLENGES OF POWERING SHIPS WITH AMMONIA

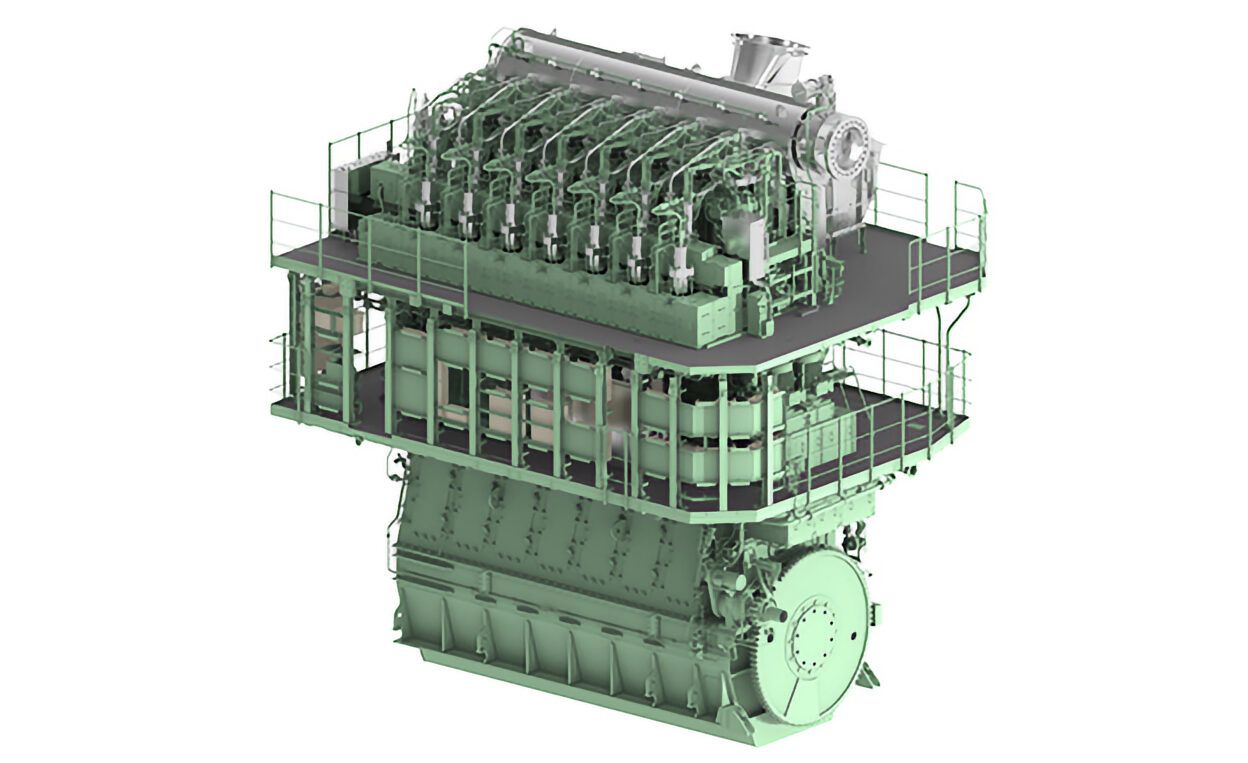

The first challenge analyzed in the DNV report is the ability to build ships that can be powered by ammonia. According to the study, its viability in ships has already been demonstrated—in September 2025, Japan Engine Corporation presented the world's first commercial ammonia engine—and the technology is being installed in some newbuild vessels. However, there is still a long way to go before a scaling phase can be discussed.

- "Currently, significant progress is being made in the development of propulsion engines, but if consolidation is not achieved, it is due to investment issues, not technological ones," explains Pedro López, Business Development Director at Seaplace, a company specialized in offshore engineering consulting and ship design. "Technology already exists for two-stroke engines, used in very large ships such as tankers or super-container ships, to use ammonia as fuel. However, it is still under development for four-stroke engines, typical of smaller vessels such as ferries or oceanographic ships. The technology has not reached a sufficient level of maturity to be used commercially," López notes.

Another major challenge lies in ensuring safety, due to ammonia's toxicity to humans. "Given that the consequences of direct exposure to ammonia can be serious, technical safety measures integrated into the ship's design, as well as operational procedures, must aim to minimize and control ammonia releases," DNV explains. "Compared to other alternative fuels, ammonia raises more concerns due to its toxicity.

Maritime transport carries many types of dangerous goods, it is accustomed to dealing with toxic products, and that is why sufficient safety measures will be implemented to be able to operate ammonia safely," Pedro López notes. According to the Seaplace development director, the ALARP safety criterion is followed, which stands for As Low As Reasonably Practical and establishes that measures must be applied to reduce risk to a level as low as feasible from a technical-economic standpoint.

"With these measures, the use of ammonia can be as safe as any other fuel. What truly solves the toxicity problem is taking safety measures, and the most important is properly training crews. Therefore, ammonia will only be used in those fleets where the level of worker training is very high. By regulation, if ammonia is transported, the crew must have specific knowledge. And, by common sense, ammonia will not be carried on a ship without a crew prepared to handle it," López concludes.

To all this are added other key challenges, such as:

- obtaining the necessary investments to advance the implementation of ammonia as an alternative fuel

- lowering its price, which according to the report is currently five times higher than conventional marine fuel

- To advance decarbonization, it is also essential to have ammonia from renewable sources. DNV estimates that global green ammonia production could reach between 10 and 12 million tons in 2030, taking into account projects whose investment has already been approved, and notes that this production is currently in an initial phase, albeit with rapid growth. "It is considered that we will be able to count on a reasonable fleet powered by renewable ammonia within about 15 years," López concludes.

THE ROLE OF PORTS

No fuel can prosper without infrastructure. And this is where port adaptations to safely supply the first ships come into play. "If it is a port that already handles ammonia as cargo, adaptations may be minor: tanks capable of holding ammonia under pressure and ducts adapted to safety requirements are required, both for toxicity and the corrosion that ammonia generates," Maurici Hervas explains. "In case cryogenic ammonia is required, which improves energy density, new installations will have to be made that allow its storage and transport, as well as the necessary cold generation."

- "On the other hand, it is necessary to develop regulations and operational procedures to be able to conduct bunkering safely. This requires safety studies and intense collaboration with all stakeholders," adds the Head of Energy Transition at the Port of Barcelona. "Ammonia is still in an initial phase in this regard, but it is possible that safety distances will be a major limiting factor when carrying out these operations in ports. It is possible that a plausible scenario would be to conduct ammonia supplies in the anchorage area, outside the port docks. This would not be the ideal situation, and it is possible that in the coming years there will be many studies and pilot tests to evaluate whether distances could be reduced."

Currently, and unlike other fuels such as green methanol, the Port of Barcelona does not have a very ambitious development plan regarding ammonia. "On one hand, there is no ammonia traffic, and on the other, it is not seen as a viable fuel in the short term. We plan to develop safety studies next year and regulation for the following year, in order to be prepared to host operations before 2030, but there are no plans to develop production or storage capacity significantly," Hervas explains.

BOOSTING AMMONIA BUNKERING IN JAPAN

- ITOCHU Corporation, TORAY Industries and Uyeno Transtech recently announced a Joint Development Agreement (JDA) for the development of an ammonia bunkering hub for ships in the country. The parties will collaborate to study the safe operation of ammonia supply facilities, obtain relevant permits, and evaluate the "commercial terms and conditions" of ammonia bunkering.

- This announcement follows ITOCHU's order for a newbuild ammonia bunkering vessel in June 2025. The company plans to use the new vessel in Singapore to conduct ammonia bunkering demonstrations and subsequently establish an ammonia bunkering business. Simultaneously, ITOCHU plans to study the development of the ammonia supply chain as marine fuel to Japan, with a view to relocating the new bunkering vessel there.

Among other ports that have taken more significant steps in this regard, according to Hervas, are Tarragona, Rotterdam and Singapore. "The Port of Singapore has a very strong action plan to maintain its position as a bunkering hub in Southeast Asia. But not only at the maritime level, but also at the national level, since they consider it their future energy vector to continue supplying energy to their city once they reduce their exposure to fossil fuels," Hervas explains.

- Energy diversity is precisely one of the keys to betting on fuels like ammonia. "The important thing about alternative fuels is precisely that they are alternatives. Their nature is not that they compete with each other, but that diversity exists," López notes.

"Oil-producing countries, such as the United States, will not bet on methanol or hydrogen cars or ships, because their own natural resource is gasoline. Those whose natural resource is gas will power their vehicles with gas. And countries that have a lot of renewable electricity generation, like Spain, will be able to bet on pure electricity, methanol or renewable ammonia. This is what makes them interesting, because they can balance energy resources globally," the expert concludes.

As proof that ammonia is gaining ground in the new fuels market, this very week the delivery ceremony of the Grande Melbourne, the latest vessel in the Grimaldi Group's fleet, has been announced. With a capacity of over 9,200 CEU (car equivalent units), this is the third in a series of seven ammonia-ready Pure Car and Truck Carriers (PCTC) ordered.