Marine algae cultivation: applications, market and sustainable future

The European macroalgae market reached $3.762 billion in 2024, representing 30% of the global market. Spain stands out with 388% growth in algae production, according to the FAO. Discover how marine algae cultivation is transforming sectors such as food, cosmetics, biofuels, and bioplastics manufacturing into a key solution for the circular economy and the fight against climate change.

Algae are not just what bothers us at the beach or what we discover when we go to an Asian restaurant. Marine algae cultivation (algaculture) for uses beyond food is a sector that moves billions every year worldwide. Although it still faces significant technical, regulatory, and economic challenges, research opens the door to real solutions for climate change, food security, and energy transition.

Macroalgae cultivation is a dynamic sector that is evolving rapidly. More and more startups and biotech companies are betting on this natural raw material, developing innovative projects with promising applications.

"We are committed to finding nature-based solutions to solve some of the challenges we face as a society today," explains Jorge Santamaría, co-founder and co-director of R&D at Algabrava, a Catalan company that has been working since 2019 to develop and promote algae cultivation in the Mediterranean Sea.

European algae market: $3.762 billion and sustained growth

China, along with other Asian powers such as South Korea and Japan, continue to firmly lead algaculture. At some distance, though with growing interest, some European economies and the United States follow, having begun to invest in research and innovation around marine algae.

The European continent, although it seems to always arrive late lately, is consolidating its presence in the search for innovative algae solutions. In 2024, the total value of the European macroalgae market was over $3.762 billion. That is, Europe represents around 30% of the global macroalgae market.

In countries like Spain, there is room for expansion, and algae production has grown by 388%, according to FAO data, underscoring interest in this natural resource and its potential within a circular economy and the blue economy.

Macroalgae are emerging as one of the most promising raw materials today. In 2022, the European Commission launched the initiative Towards a strong and sustainable seaweed sector in the EU, a pioneering strategy that contemplated more than 20 measures aimed at creating new opportunities for this industry. The objective was clear: to anticipate a growing demand for algae and derived products due to population growth and new, more sustainable consumption patterns.

Three years later, prospects for the algae sector remain optimistic. In fact, the sector in Europe is expected to grow steadily in the coming years, and the continent will continue to be one of the largest importers of marine algae-derived products.

If the industry manages to overcome current difficulties and obstacles, the European Commission estimates that demand could reach €9 billion by 2030.

Demand driven mainly by sectors such as:

- Cosmetics

- Pharmaceuticals

- Food

- Renewable energy

What are macroalgae?

- They are marine organisms that can range from a few centimeters to more than 50 meters in length. They are photosynthetic eukaryotes; they do not have roots, stems, or leaves, but possess a body called a thallus that adheres to the substrate through a rhizome. They are classified into three groups according to their pigments: green algae (Chlorophyta), brown algae (Phaeophyceae), and red algae (Rhodophyta).

- They produce oxygen, absorb CO2, are fundamental primary producers in aquatic ecosystems, provide food and shelter for many species, protect coasts from erosion, and thanks to the rise of algaculture, have multiple applications in food, cosmetics, bioplastics, biofuels, and pharmaceutical products.

Marine algae applications: food, cosmetics, biofuels, and bioplastics

Algaculture has ceased to be a traditional practice and, hand in hand with technological innovations, is projected as a key solution to combat the climate crisis and other global challenges. It is an indispensable part of the blue economy and allows:

- Regenerating aquatic ecosystems

- Absorbing large amounts of CO2

- Obtaining sustainable products without wasting terrestrial resources

- Reducing dependence on polluting raw materials

The research lines developed by Algabrava are as diverse as they are ambitious. Among its most notable projects is the development of ruminant feed capable of reducing methane emissions from cows, one of the most potent greenhouse gases.

Currently, marine algae are already part of:

- Snacks and nutritional supplements

- Condiments and functional foods

- New drugs and medical treatments

- Beauty products and anti-aging creams

- Natural fertilizers

- Bioplastics and compostable packaging

Algae for biofuels and sustainable materials

The versatility of marine algae extends even further: some algae species, rich in sugars and lipids, can be processed for the production of biogas or biodiesel. Others are used in manufacturing compostable packaging, ecological textiles, natural fertilizers, or biodegradable and water-soluble bioplastics.

As Jorge Santamaría points out, the potential of algae extends even to the energy and materials field. "There are initiatives being developed to make biodiesel or bioplastics. Many UV filters that were previously made with aluminum compounds can now be manufactured with natural products derived from algae," he indicates.

Algae offer multiple pathways for biofuel production. Their viability has been studied since 1942, and various companies have invested heavily in their development. The idea is that their lipid fraction can be converted into biodiesel or direct petroleum substitutes through refining processes. At the same time, their carbohydrates are fermentable to produce bioethanol or butanol, maximizing the energy utilization of algal biomass. However, high costs have been slowing their development until now, when new techniques appear that could boost their economic viability.

European legislation on algae: regulations and authorized species for human consumption

Legislation is undoubtedly one of the key pieces for the development of this sector in Europe. And it depends largely on the final destination of the product.

In the food sector, for example, restrictions are particularly strict. "You have to abide by European regulations on food or dietary supplements, and until now, only about 30 species were permitted," explains Santamaría. In this regard, he celebrates that "in recent years, new species are being included to expand the range that can be applied to human consumption."

It is not an easy path. As happened with the introduction of chia in Europe, the lack of tradition in consuming certain plant foods of marine origin implies a slow process, both for their approval as a "novel food" and for integration into the population's regular diet.

Algae bioplastics: sustainable alternative to conventional plastic

Algaculture also demonstrates the possibility of proposing sustainable alternatives to terrestrial resources. A clear example comes from the company B'ZEOS, specialized in manufacturing algae-based packaging. This blue biotechnology startup of Norwegian origin landed a few months ago at DFactory Barcelona, the innovation hub promoted by the Consorci de la Zona Franca de Barcelona.

From Barcelona, B'ZEOS continues developing innovative products such as their algae pellets that can be transformed into sheets or trays and serve as a base for highly versatile final packaging. All made from brown and red algae from France and Norway. They are therefore a clear ecological alternative to conventional plastic, which is much more complex to recycle and much more polluting.

Algae in food: culinary uses, nutraceuticals, and hydrocolloids (agar-agar)

1. Direct culinary use

The most traditional—though still incipient in Europe—is their direct use in cooking. "Algae are used as if they were a vegetable: they can be consumed raw, cooked... For years, in haute cuisine, it has been common to find dishes that include algae as one more ingredient," affirms Jorge Santamaría.

The real challenge is to generalize their use beyond these avant-garde restaurants and bring them closer to the general consumer. "Now an attempt is being made to take the step so that Europe develops a gastronomic culture around algae similar to many of the reference countries in Asia," he highlights.

2. Nutraceutical algae

Another expanding avenue for this industry is nutraceuticals, where algae are processed to obtain functional components that provide health benefits. "It's about using the beneficial components of algae to create shakes rich in minerals, fatty acids, or supplements that provide extra nutritional value," explains the co-founder and co-director of R&D at Algabrava.

3. Hydrocolloids: agar-agar and other gelling agents

The largest production volume in food comes from the hydrocolloid industry. "The field that moves the most algae is the production of agar-agar, a gelling agent widely used in preserves and processed products," comments Santamaría.

In fact, agar-agar is the world's healthiest natural hydrocolloid and is obtained from red algae of the Rhodophyceae class.

Future of algae cultivation in the Mediterranean

The future vision at Algabrava is optimistic and ambitious. "In five to ten years, the sector will have managed to position itself and demonstrate that today it is a promising innovation," affirms the researcher. His hope is that the algal biomass being cultivated today under experimental conditions can be key to mitigating global problems such as water pollution, fuel sustainability, or the environmental impact of livestock farming.

With scientific backing, technological innovation, and market momentum, algae could cease to be an underutilized resource and become a pillar of the European bioeconomy of the future. For all these reasons, Algabrava works daily on identifying native Mediterranean species with high-value applications.

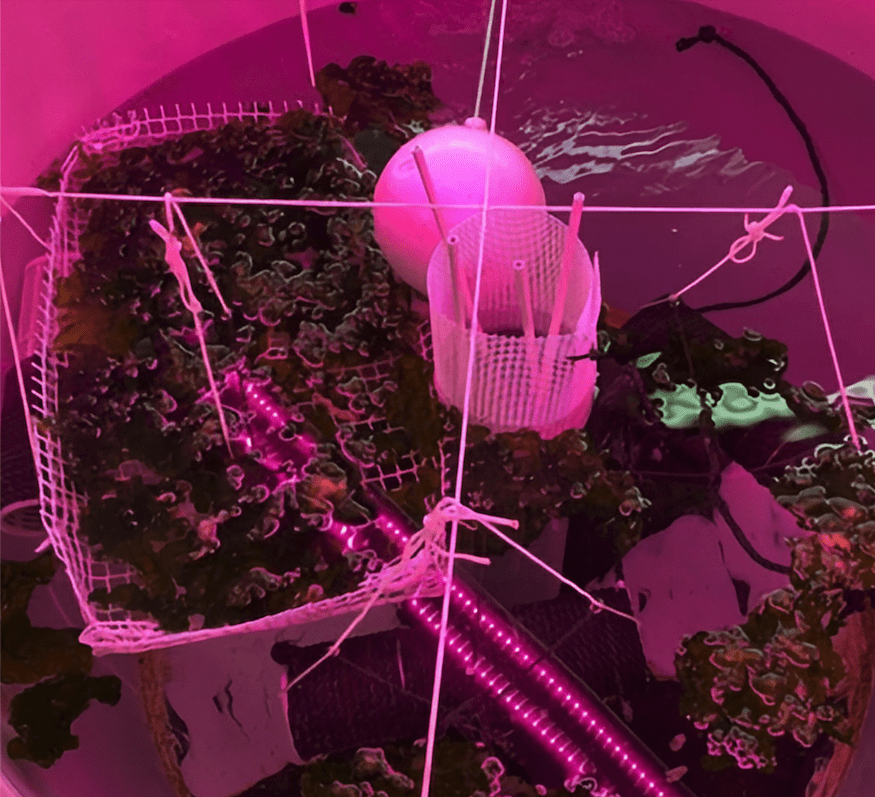

To reduce dependence on direct harvesting from the sea, the startup has developed its own algae seedling system. "We identify species, develop their cultivation in the laboratory, and create seedlings so we don't have to go to the sea to collect them each time," he explains. This strategy not only improves efficiency but also reduces environmental impact.

Currently, Algabrava is completing construction of its pilot plant in the Ebro Delta. "The idea is that by the end of this year or early 2026 we'll be at 100% industrial production," anticipates Santamaría.

Finally, they are promoting integrated multitrophic aquaculture projects, a model that allows cultivating different species in the same system, benefiting from each other.

"We work with mussel producers in the Ebro Delta to cultivate algae seeded on ropes, similar to what is done in Norway, Sweden, or Japan. This way they can place them in the same infrastructure where they have the mussels and make production more sustainable," explains Santamaría.

A blue future beneath the sea surface

Marine algae cultivation represents much more than a business opportunity: it is a tangible response to 21st-century challenges. From reducing methane emissions in livestock to creating biodegradable bioplastics, through CO2 capture and aquatic ecosystem regeneration, macroalgae are demonstrating their key role in the transition toward a more circular and sustainable economy.

With Europe consolidating as a $3.762 billion market and projections pointing to €9 billion by 2030, the algaculture sector is in full expansion. Spain, with its 388% growth in production, positions itself as a relevant actor in this scenario.

Projects like those of Algabrava in the Ebro Delta or B'ZEOS in Barcelona show that the future of algae is not only in Asia. The Mediterranean, with its native species and innovative sustainable cultivation systems, can become a reference for the European blue bioeconomy.

The sea hides solutions we are just beginning to explore. Marine algae are undoubtedly one of the most promising.