This article analyses the impact of the EU ETS on container traffic and the consequences of a possible reconfiguration of the routes. (Getty Images)

This article analyses the impact of the EU ETS on container traffic and the consequences of a possible reconfiguration of the routes. (Getty Images)

The turbulent future for European maritime transport with the announced extension of the EU ETS

The extension of the EU ETS to maritime transport aims to reduce the sector’s GHG emissions. It is going to be an important step for the decarbonization of transport, but is there any collateral damage?

Javier Garrido is a researcher at the Center of Innovation and Transport (CENIT) and PhD student at Port de Barcelona.

Maurici Hervas is a researcher at CENIT and PhD student in energy transition at the Port of Barcelona.

Chiara Saragani is a researcher at CENIT and PhD student in digitalization at the Port of Barcelona.

This article analyses the impact of the EU ETS on container traffic and the consequences of a possible reconfiguration of the routes. (Getty Images)

This article analyses the impact of the EU ETS on container traffic and the consequences of a possible reconfiguration of the routes. (Getty Images)

European Ports are sailing towards Carbon Neutral

In 2015, the Paris Agreement (COP21) pushed the European Union towards creating its own strategy concerning the achievement of the 2050 sustainable objectives, and thus, the Green Deal. It aims to lead EU members towards green transition and climate neutrality through a series of initiatives.

Within the Green Deal, the maritime transport sector plays an important role, despite the fact that it only represents between 3% to 4% the total CO2 emissions produced by the EU.

To reduce greenhouse emissions, the EU decided to create a package of policies, named “Fit for 55”, in which the maritime sector is heavily involved. Specifically, one of these sanctions appears to be particularly delicate: the EU Emissions Trading System (EU ETS).

EU ETS extension: a measure with a rocky progression

The European Union estimates that the EU ETS represents a fundamental step for the abatement of greenhouse gas emissions, targeting at least a 43% reduction by 2030 compared to 2005.

The inclusion of the maritime sector into the EU ETS was previously analyzed on this channel within the article named “The impact of the EU Emissions Trading Scheme (ETS) on maritime transport”.

The decision-making process of this measure has not been smooth. Indeed, the text has already seen several modifications even though it is not approved yet.

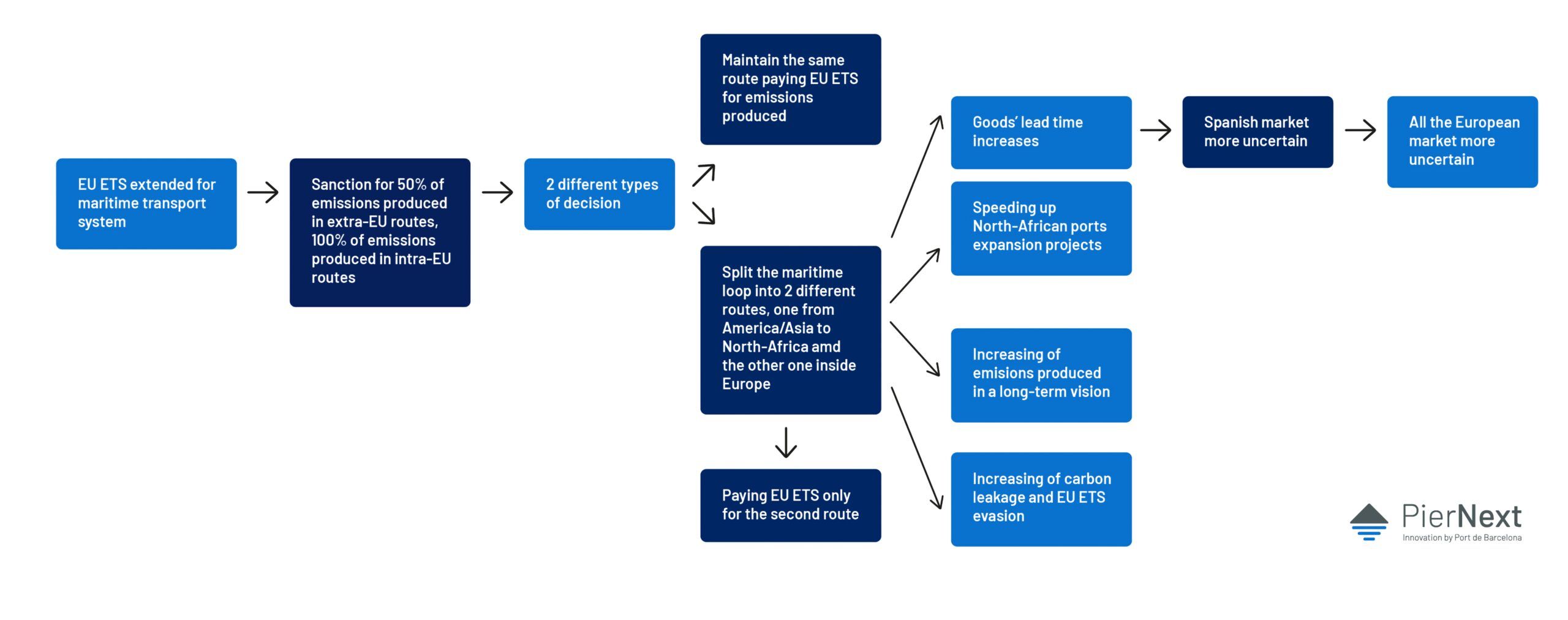

After a review by the Council and the Parliament, the directive will include the maritime sector in the EU emissions market earlier, from 2024, with a phase-in period. The scope is limited to 50% of emissions for routes between EU and non-EU ports, and 100% of emissions produced for routes inside the EU.

Not only is the maritime transport sector affected by the EU ETS, but other sectors are also included. The emission rights payments received are allocated to diverse funds, one of them being the Social Climate Fund, which helps EU citizens and micro-companies to invest in sustainable energy measures. Moreover, the Modernization Fund and the Innovation Fund were also created. The first one supports ten EU members during their climate neutrality transition, while the second one promotes innovative low-carbon technologies.

The following table shows the development of the measure:

EU ETS evolution process: three different changes

The extension of the EU ETS to maritime transport will help to decarbonize the economy and accelerate the implementation of more sustainable technologies. At the same time, some adverse effects could appear since the policy is not going to be applied on a global scale. Although, maritime transport is an international business subject to external factors.

Therefore, “Puertos del Estado”, a public entity which is responsible for Spanish ports, decided to investigate the impact this measure would have on ports such as Barcelona, Algeciras and Valencia and its knock-on effect on the Spanish economy.

A first study was developed by each of these ports, and a second in-depth study was conducted in order to consolidate the results and then perform an analysis of the possible evasive mechanisms. This last study was conducted by the Center for Innovation in Transport (CENIT), an investigation center in Barcelona specialized in logistics and transport challenges.

CENIT investigates possible negative impacts of the EU ETS on the Spanish maritime sector

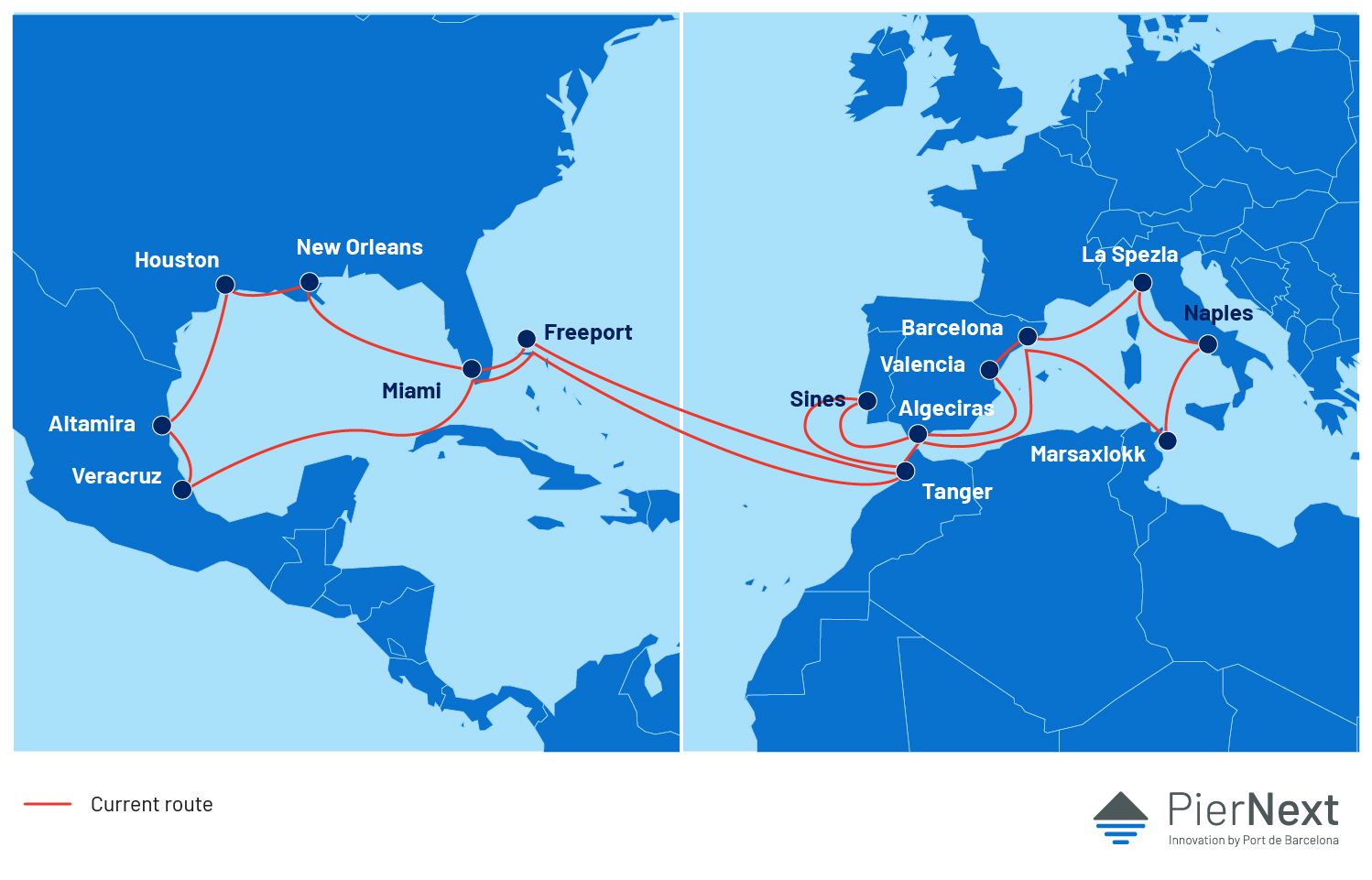

The research study considers the main container routes which connect Spanish Mediterranean trade, in particular, products handled by Algeciras, Valencia and Barcelona ports. The study takes into account 8 routes between America and Europe and 6 routes between Asia and Europe.

These routes have a regular frequency, and they are considered relevant enough, given that they cover a significant percentage of the total maritime traffic for the ports studied.

Currently, the routes perform a loop between America and Europe or between Asia and Europe.

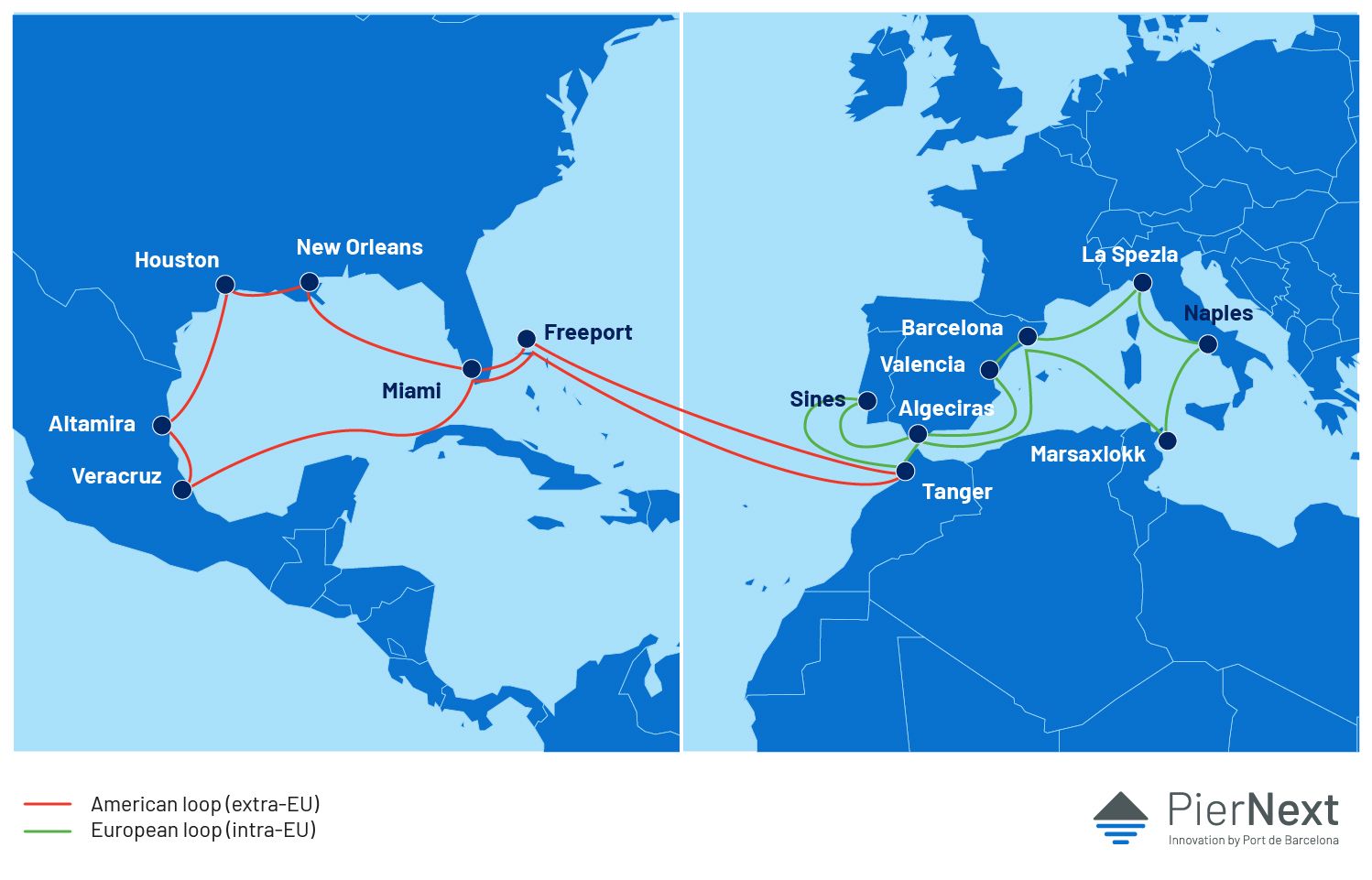

Due to the EU ETS implementation, shipping companies could decide to split this loop in two.

To be more precise, they would first leave the containers in a North-African port, then they would move the goods to Europe with a second loop. In this way, the first route would not fall under the scope of the EU ETS, effectively minimizing the carbon emission costs of the route.

The following images shows an example of this choice.

But firstly, do African ports have the capacity to manage this huge amount of containers?

The EU ETS could help speed up the expansion plans of North-African ports

CENIT’s study includes an analysis of the effective possibility of separating in two the container loop coming from America or Asia. This study showed that North Africa already has some ports exchanging goods with the European market. Moreover, it was noticed that some of these ports are very close to each other, and they could decide in the future to collaborate, in order to manage goods’ flow better.

Relevant examples of this possibility could be the port of Tangier together with the port of Nador, or Port-Said and Damietta – they are separated by 70 km – together with the port of Alexandria.

Finally, Algeria and Tunisia intend to expand their strategic maritime connections and they are also planning the development of deep-water ports close to their main cities.

These North African ports could become transshipment hubs in the future, and some of the most important shipping companies are already investing and are willing to contribute to their development. In this way they would reduce their exposure to the ETS and thus maintain a competitive advantage in the European market.

Hence, shipping companies’ funding could speed up the ambition of the north African countries to become an important reference point for the maritime transport system.

Opportunities and threats to the reconfiguration of lines

The implementation of the EU ETS could lead to shipping lines making a first stop in North Africa, the Adriatic Sea, the UK or the Eastern Mediterranean

What would be the consequences for Europe?

Quantifying the negative impacts for the reconfiguration of maritime routes

Taking a closer look at the CENIT research study, an analysis was conducted in terms of costs, time, emissions produced and carbon leakage.

The study examines three different scenarios, with three different time periods – short-term (2025), medium-term (2030) and long-term (2040) - and these scenarios were compared with the current situation. The study chose to focus on container shipping, as this represents around 90% of the total number of transported products. Nevertheless, negative implications would also appear for other modes of transport, such as roll-on/roll-off market, liquid and solid bulks and short sea shipping.

In order to quantify the impact of these new transport routes, CENIT analyzed the main cost variations compared to the baseline scenario.

The main costs considered are as follows:

- Navigation costs: fuel, capital, operational;

- Emissions costs: costs to be paid in order to comply with the EU ETS;

- Container operation costs: costs correlated to containers loading and unloading;

- Port call taxes: taxes to pay to entera specific port;

- Crew costs: costs related to the crew on a ship.

The considered values are the result of accurate research in order to reproduce the closest approximation to reality, investigating real information coming from the interested routes.

The EU ETS could move shipping companies towards more economic but less sustainable logistics

Results coming from the study show that route reconfiguration would generate cost savings for shipping companies. However, emissions could increase, and a significant amount of tax evasion would occur, for both transatlantic and eastern routes.

Concerning transatlantic routes, 6 out of 8 of them would save money with the reconfiguration. This reconfiguration would result in an increase in emissions of between 0.5% and 24% in the long-term, compared to the baseline scenario.

Eastern routes show the same results, emissions would be raised by between 1% and 5% compared to the current situation.

Finally, carbon leakage would be significant for all routes. Carbon leakage is the transfer of emissions from a specific country to other regions with the aim of avoiding rigid climate policies.

Table results for short, medium and long term in both transatlantic and eastern itineraries

Maritime route reconfiguration could make the European supply chain fragile

The EU ETS could lead shipping companies towards the reconfiguration of maritime routes connecting Europe. Indeed, companies could decide to split routes into two phases: one from the origin to an African hub and the second one from Africa to Europe. In this way, companies will pay just the emissions costs for the second trip, since the EU ETS is only applied in European maritime boundaries.

The route reconfiguration could speed up the process of African hubs expansion, resulting in the loss of transshipment traffic. Even though the majority of the lost traffic would be transshipment, the I/E activity would also suffer due to lead time increases.

The products' time growth would make the European supply chain more uncertain due to the intermediate stop, resulting in further expenses. Moreover, the reconfiguration leads to an increase in GHG emissions in the long-term, which is entirely counterproductive to the EU ETS’s objectives.

Finally, it is possible to state that the reconfiguration would produce negative impacts not only for Spanish trade, but also the entire European one.

Indeed, similar effects could be produced in the North-European maritime routes. Shipping companies could decide to split the loop in a port of the United Kingdom, since UK ETS will not include international shipping, instead relying on the IMO efforts.

Moreover, other reconfigurations could emerge in the Adriatic traffic and Eastern Mediterranean, moving the original paths towards Turkish and Egyptian ports.

Summary outline of impacts of the inclusion of maritime transportation in the EU ETS for the Mediterranean region

Decarbonization will only be achieved by working together

The study from CENIT shows how the EU ETS would impact on the European maritime system negatively. The main reason is that the measure would only be applied for journeys inside European boundaries, giving the shipping companies the possibility to evade EU ETS costs, by introducing intermediate transshipment hubs in non-EU countries.

The pre-agreement contemplates the possibility of evasive maneuvers and requires that the Commission monitors these trends in order to detect them at an early stage and propose measures to address them.

Nonetheless, this mechanism relies on an active observatory. Conversely, the implementation of measures for the reduction of GHG emissions would be more efficient if all countries were involved. This choice would avoid tax evasion and shipping companies would start to focus their resources on more sustainable solutions instead of new strategic logistics hubs.

In 2015, the International Maritime Organization (IMO) started some initiatives aiming to reduce maritime emissions gradually, but the reality is that little practical action has been taken.

The European Union should take a more insistent approach with the IMO and try to put more pressure to extend the EU ETS to all countries.

Moreover, a strategic plan for funding allocation could be proposed.

The EU and the IMO could use the ETS to invest in those countries where the economy is instable, helping them towards energy transition and a better administration of their strategic hubs.

They could also promote the research of innovative solutions which could help to speed up the clean energy implementation process.

One example could be the funding for the renewal of the fleets with more sustainable ships, generating in this manner benefits for both the environment and the shipping business. Thus, reducing the reluctance of the involved companies to assume the carbon tax.

Finally, another option would be the implementation of “Contracts for Difference”. It is a program aiming to incentivize private investments for the production and use of scalable zero-emissions fuels (SZEFs), due to the high costs these technologies still have. Hence, the main objective of this program is to reduce the gap between old and promising new technologies as soon as possible.

This article analyses the impacts for container traffic, but what about the motorways of the sea, cars, liquid bulk, cruises and others? CENIT will carry out further research to explore the impacts for different maritime sectors.