Officially proposed by the Chinese president in 2013, the Belt and Road Initiative has provided a political and economic foundation for the rail service between China and Europe.

Officially proposed by the Chinese president in 2013, the Belt and Road Initiative has provided a political and economic foundation for the rail service between China and Europe.

A brake on the China-Europe train: how the war in Ukraine impacts on the new silk route

One of the strategic projects of the Belt and Road Initiative (BRI), the train between China and Europe, is experiencing several complications due to the war in Ukraine, in addition to the latest pandemic. This context is causing a series of consequences and decisions that may mark the future of transcontinental rail connections.

Gemma Garcia is the Foreland Manager in the Business Strategy Department of the Port of Barcelona.

Yan Gu is an Intern in the Business Strategy Department of the Port of Barcelona.

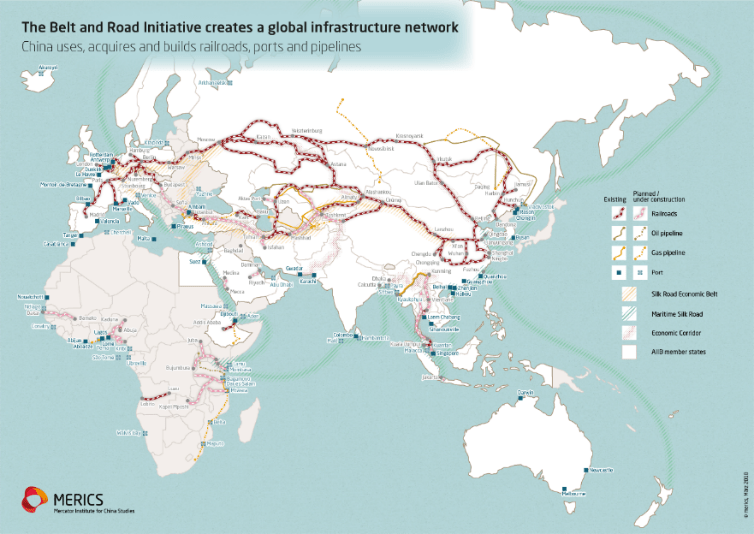

Officially proposed by the Chinese president in 2013, the Belt and Road Initiative has provided a political and economic foundation for the rail service between China and Europe.

Officially proposed by the Chinese president in 2013, the Belt and Road Initiative has provided a political and economic foundation for the rail service between China and Europe.

Background for the first train between China and Europe

March 2022 marked eleven years since the first China-Europe train was launched. As a vital flagship project under the Belt and Road Initiative (BRI), rail services between China and Europe have developed rapidly in the last decade.

Officially proposed by Chinese President Xi Jinping in 2013, the BRI has provided a political and economic basis for this development. By the end of January 2022, more than 50,000 trains between China and Europe have transported more than 4.55 million TEUs worth US$240 billion.

These trains operate on three routes, connecting China with 180 cities in 23 European countries. The main and most common route is the northern route, which runs through Kazakhstan, Russia, Belarus and Poland. The Yiwu (China) - Madrid route is also operated via this route.

First launched in 2014, the Yiwu - Madrid line is the longest rail transport service in the world: it covers 13,052 km in 16 days. It is capable of carrying a total of 30,560 cubic metres of goods weighing over 1,000 tonnes.

The operators behind these trains

Many logistics and freight forwarding operators, both local and of European origin, have been actively involved in the management of the China-Europe (CE) trains. In the current context of pandemic and global shipping congestion, this cross-border train has been "a very solid alternative for products with added value and the need for immediacy in their movement," according to Carlos Santana, former director of the Yiwu-Madrid railway company, YXE.

- Sinotrans, one of the largest freight forwarding companies in China, has been one of the CE train operators with the widest service coverage. It has shipped more than 5,000 trains between China and Europe and developed more than 50 new lines.

- In the cases of Cainiao and JD Logistics, as the own logistics companies of the two Chinese e-commerce giants Alibaba and JD.com, it has its own lines to transport cross-border e-commerce orders to expand into the European market. Cainiao's main line is Yiwu-Liege (Belgium) and JD Hamburg/Duisburg-Xi'an.

- As for European operators, DHL, DSV and DB cargo, among others, also offered services connecting several Chinese cities with Europe. However, in the wake of the war in Ukraine and sanctions against Russia, many operators prefer to avoid using services across Russia.

Before the pandemic, the service took about 22 days to central Europe and 26-27 days to Spain, explains Jorge Valera, DSV's Strategic Accounts Manager for Rail & Short Sea Shipping. "For several months we experienced severe difficulties, as the Kazakh-Russian border was closed several times due to Covid-19 and this caused major bottlenecks," he says. Today, many global freight forwarders have stopped their CE train services, even though the operation of the trains has not been affected by the war.

In addition to freight forwarders, shipowners are also involved in CE train operations in order not to lose market share and to take advantage of the opportunity to promote a complementary service to maritime transport: multimodal transport.

- Cosco, the largest Chinese shipping company, has long been involved in the China-Europe rail-related business. In recent years, it has actively promoted the development of new international rail and mixed (rail-sea) corridors.

- Recently, Maersk has also been actively involved in the development of the China-Europe trains in collaboration, for example, with the German rail operator RTSB.

- Finally, CMA CGM is also involved through its subsidiary CEVA Logistics.

By the end of January 2022, more than 50,000 trains between China and Europe will have transported more than 4.55 million TEUs worth USD 240 billion

The China-Europe rail and the Ukraine war: uncertainties and concerns

The war between Ukraine and Russia has cast a shadow over the future of the China-Europe rail service. Although trains passing through Ukraine accounted for only 2-3% of the total volume, sanctions against Russia have created uncertainty on the main routes passing through Ukraine.

Apart from boycotts by some operators, cargo owners are also concerned about the safety of their goods and freight settlement with Russia. Carlos Santana says that services still exist today, "but the uncertainty of the war is causing some customers to look for alternative services to rail transport. This has affected demand for the first time since its implementation," he shares.

The volume of China-Russia trains remains, however, at a high level. It mainly transports essential and/or cheap goods that Russia does not produce and imports from the Asian giant.

The alternative: the southern corridor

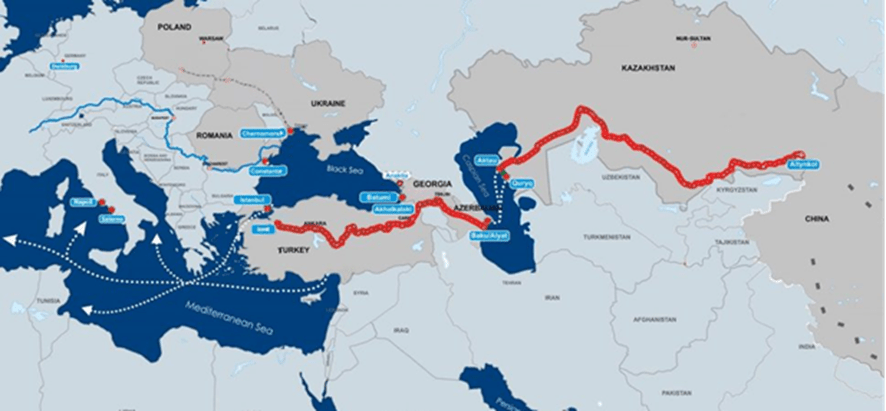

Due to the uncertainties caused by the main line, the market has turned its attention to the southern corridor. This line is a multimodal transport route that crosses Kazakhstan, the Caspian Sea, Azerbaijan, Georgia and Turkey, from where it reaches Europe. However, it has only taken around 3-5% of the total capacity of the main lines.

The lack of infrastructure and continuous modal shifts mean that this corridor is not ready to handle the volumes carried by the main line. According to Valera, this alternative route is currently not viable "neither in terms of transit time nor capacity." Countries are already looking to cooperate and attract investment to develop this route, but more time is needed.

The future of China-Europe rail services

Despite the many challenges mentioned above, Carlos Santana and Jorge Valera are confident about the future development of the China-Europe train. According to Valera, "as soon as the conflict is resolved, the service will be restored."

Santana adds that it will be necessary to keep an eye on the collapse and stoppage situation in the ports of Shanghai and Ningbo due to the coronavirus, the lack of drivers and how this affects maritime traffic. "The rail option will always be there," he says confidently.

Moreover, in this era of sustainability, the industry must take into account not only transit time and price. "Sustainability must be added to the two concepts described above," Santana explains, "which favours the development of rail services."

This is the great asset and competitive advantage of rail transport, being the transport alternative with the lowest carbon footprint. We will see what happens in the coming months: whether other alternative routes are consolidated if the conflict carries on or whether we will have to wait for a peace agreement to be reached that will allow this ambitious rail service to restart.