European growth targets will force an unprecedented increase in demand for critical raw materials. (Getty Images)

European growth targets will force an unprecedented increase in demand for critical raw materials. (Getty Images)

The supply of critical raw materials: a challenge for Europe

Europe's ambitious plans for a green and digital transformation depend on its ability to source certain raw materials that are essential for the development of strategic sectors. Unfortunately, in many cases, the EU relies on imports for these critical raw materials (CRMs). To ensure their availability, last March the EU proposed a new regulation to guarantee their future supply. The aim is to bring Europe into the supply chains of these products and reduce our dependence.

Carles Rúa is the Chief Innovation Officer at the Port de Barcelona and Director of the Master’s degree in Executive in Supply Chain Management at the UPC.

European growth targets will force an unprecedented increase in demand for critical raw materials. (Getty Images)

European growth targets will force an unprecedented increase in demand for critical raw materials. (Getty Images)

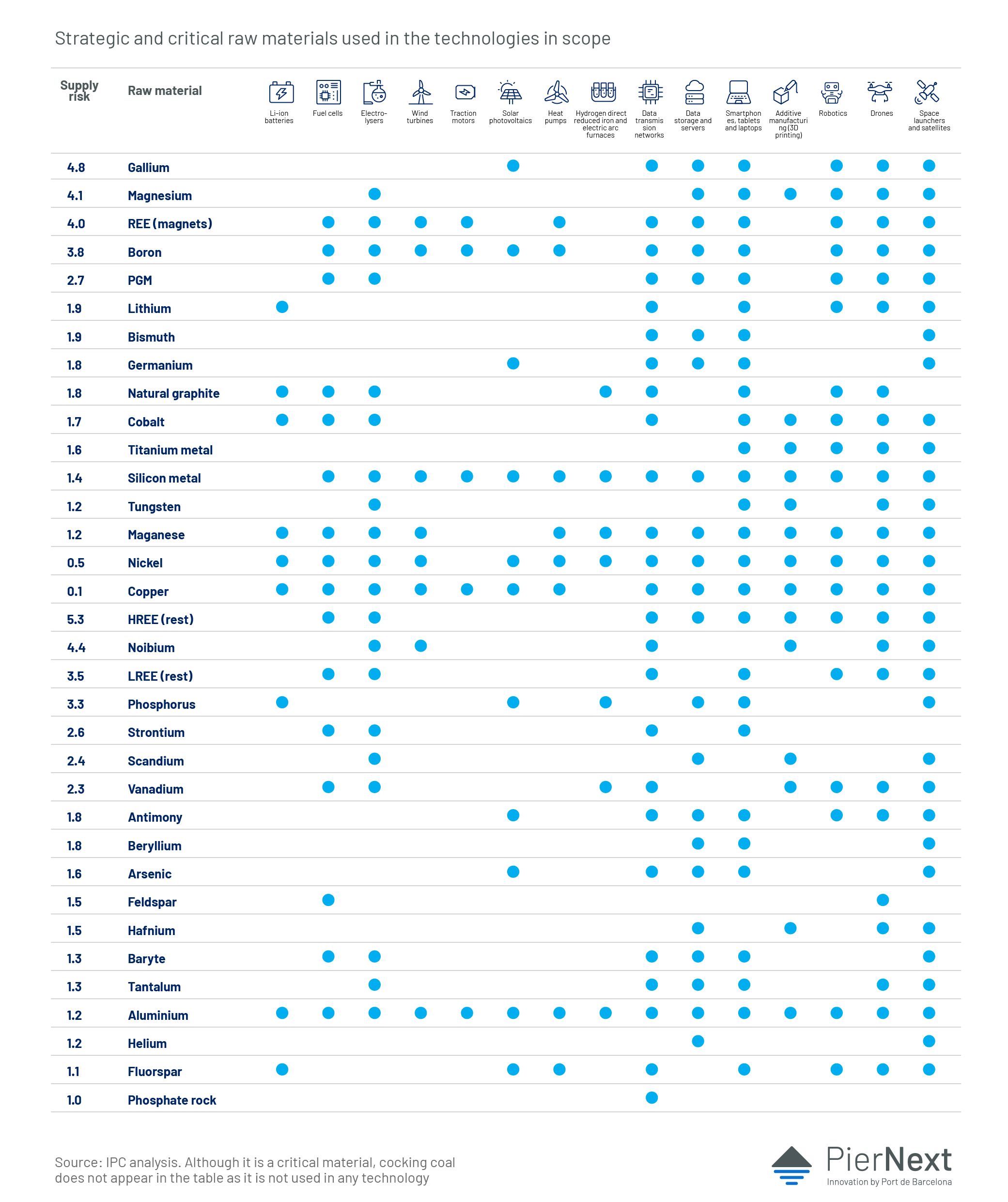

In 2023, the European Union published the prospective study "Supply chain analysis and material demand forecast in strategic technologies and sectors in the EU - A foresight study". Prepared by the Joint Research Centre, it analyses the value chains associated with fifteen key technologies linked to five strategic sectors for the EU: renewables, electromobility, industrial, digital and space/defence.

The main conclusions are that these fifteen technologies require an extensive set of 34 raw materials that can be considered critical or fundamental for European technological development and whose supply must be secured.

As examples, lithium, cobalt, graphite and nickel are used to produce the batteries mostly used in electronic products or electric vehicles; gallium is used in solar panels; raw boron is used in wind technologies; titanium and tungsten are used in the space and defence sectors.

Dependence on the demand for raw materials

European growth targets will force an unprecedented increase in demand for these critical raw materials. For example, by 2050, European demand for nickel, lithium and graphite will increase by a factor of 16, 21 and 26 times their current values respectively.

This demand, moreover, will not only grow in the EU but also globally: other countries will compete with Europe for adequate sources of supply for these materials. And with the aggravating factor that these are products for which Europe is particularly dependent on imports from third countries, especially China, which represents a serious strategic supply risk.

This dependence does not only occur at the extraction stage of the product, but can also occur at various stages of the value chain, such as refining, processing and final assembly. In fact, in some cases, such as the production of chips or photovoltaic panels, dependence on third countries extends to all stages of the value chain.

An added risk factor is that, for some of these raw materials, generating supply can be a very slow process: identifying new deposits, obtaining the necessary permits to start operating a new mine or increasing capacity can take years.

At the geopolitical level, the risk of disruptions in the supply chains of these critical raw materials is high, which would jeopardise the strategic sectors that drive European development and, therefore, the continent's growth and sustainability. Action is therefore needed to mitigate their impact.

The study recommends the development of initiatives in four distinct areas:

- Diversify the supply of materials and establish long-term agreements with its suppliers.

- Increase the manufacturing capacity of components in the EU.

- Improve the circularity of these products, their recycling and reuse.

- Seek substitution and alternative solutions where possible.

How does Europe defend the supply of critical raw materials?

In order to have resilient supply chains for these critical raw materials, on the 16th of March the Commission published the Communication "A secure and sustainable supply of critical raw materials in support of the Twin" together with a proposal for a Regulation to reduce their high dependency.

This regulation identifies 34 critical raw materials for the EU and sets out a set of initiatives to secure the supply of these CRMs based on three pillars:

First: developing the value chain for critical raw materials in the EU. To this end, the EU has established a list of 34 critical raw materials, updating the list that has been in place until now, and, from this, has established a second list of 16 strategic raw materials (SRMs).

Strategic raw materials

- Bismuth

- Boron - metallurgical grade

- Cobalt

- Copper

- Gallium

- Germanium

- Lithium - battery grade

- Magnesium metal

- Manganese - battery grade

- Natural graphite - battery grade

- Nickel - battery grade

- Platinum group metals

- Rare earth elements for magnets (Nd, Pr, Tb, Dy, Gd, Sm and Ce)

- Silicon metal

- Titanium metal

- Tungsten

List of strategic raw materials for the EU, according to the Proposal for a Regulation of the European Parliament and of the Council establishing a framework for securing a safe and sustainable supply of critical raw materials and amending Regulations (EU) 168/2013, (EU) 2018/858, 2018/1724 and (EU) 2019/1020.

This subset of strategic raw materials is determined on the basis of their relevance for Europe's green and digital transition, as well as for space and defence applications, taking into account the amount of technologies classified as strategic that use them as an input, the amount of raw materials needed for the manufacture of relevant strategic technologies, and the expected global demand for these technologies.

Four major targets have been set for these SRMs for 2030:

- At least 10% of SRM production must take place within the EU itself, provided that domestic stocks of these materials exist.

- At least 40% of the processing and refining of these strategic materials should take place within the EU.

- At least 15% of Europe's SRM needs to be obtained through recycling and reuse.

- Less than 65% of annual consumption for each of these materials should come from a single producer country, in each of the different critical stages of the process.

If Europe is to develop its sustainability and digitisation policies, it must ensure the secure, sustainable and affordable sourcing of Critical Raw Materials

For Europe to develop these value chains and meet these objectives, it will need to invest more in research, innovation and training both in Europe and in partner countries.

Europe must:

- Train professionals in the sector (geologists, engineers, miners, etc.).

- Promote innovation and the development of new technologies in the field of new materials and finance, through the Horizon Europe programme, projects linked to the detection, extraction, processing, reuse, recycling and recovery of CRMs.

- Facilitate the financing of investments as private funding will not be sufficient and should therefore work with the European Investment Bank (EIB) and other mechanisms of the InvestEU programme.

- Facilitate the creation of resilient supply chains by reducing bureaucratic red tape (e.g. associated with extraction permits).

- Maintain greater control over logistics chains (e.g. through auditing or testing of production companies or coordinating stocks of critical materials between member states).

- Ensure the sustainability of the processes linked to these materials, by establishing a list of practices for CRM extraction and processing activities to be considered sustainable in the framework of the Taxonomy Regulation (and therefore eligible for European funding and loans).

Second: to accelerate the diversification of supply sources by establishing global agreements with producer countries, since Europe will continue to rely mainly on imports in the future.

In this regard, the EU proposes the creation of a Critical Raw Materials Club, with key international partners. It would function in a similar way to existing major intergovernmental groups such as the G7, the G20 and the International Energy Agency.

But while the EU currently has the largest network of trade agreements in the world, it will also need to develop new agreements with third countries, either multilaterally or bilaterally.

In this sense, Europe aims for a genuine integration of value chains with its producer partners, including cooperation, identifying strategic projects that are beneficial for both parties and helping these third countries with concrete infrastructure and connectivity projects.

Third: promote circularity and sustainable sourcing by establishing extraction and production standards that are sustainable and comply with ESG (Environmental, Social, Governance) principles. In this sense, the international agreements that are established in the diversification process should take into account the sustainability of international chains.

Likewise, at present, the recycling ratios of CRMs are very low and need to be increased. Here it is also important to include third countries through strategic agreements that facilitate the import of recycled waste or to modify the legislation of different industrial sectors to take into account recovery and recycling after the end of the useful life of the products that use these CRMs.

In short, if Europe is to develop its sustainability and digitisation policies, it will need to ensure the secure, sustainable and affordable sourcing of Critical Raw Materials. This will only be possible through a set of initiatives, both within the EU and with third countries, covering the entire value chain linked to these CRMs.

Examples of key raw materials

Lithium

Lithium is a light, soft, silvery-white, alkaline metal, highly reactive due to its low density and tendency to lose electrons, a property that makes it suitable for the manufacture of batteries, its best known and most widespread use (manufacture of rechargeable batteries used in electronic devices, mobile phones, laptops, tablets and electric vehicles).

But it is also used in the production of ceramics and glass, in the production of high-temperature lubricants, light metal alloys, drying agents for air conditioning and refrigeration systems, and in the manufacture of medicines and the treatment of psychiatric disorders.

Indeed, its demand has increased significantly in recent years due to the growth of the electric vehicle industry and the demand for rechargeable batteries. In fact, according to World Energy Trade, the demand for this metal will increase 25-fold by 2050.

What challenges does Europe face with lithium? Global production in 2022 was estimated at 130,000 tonnes, of which 61,000 tonnes were extracted in Australia, 39,000 tonnes in Chile and 19,000 tonnes in China. Three countries that therefore account for more than 91% of the world's supply of this mineral. As far as global reserves are concerned, it is estimated that more than 75% of them are located in the so-called Lithium Triangle between Chile, Bolivia and Argentina.

Rare earths

Rare earths are the common name given to 17 chemical elements: scandium, yttrium and the 15 elements of the lanthanide group. They are subdivided into light rare earths (LREEs) which include: lanthanum, cerium, praseodymium, neodymium, promethium and samarium and heavy rare earths (HREEs) which include: europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium and lutetium.

Because of their magnetic, electrical and luminous properties, they are important components in high-tech devices: mobile phones, batteries, wind turbines, electric vehicles, lasers, radar, guided missiles, LCD screens, magnets, ceramic catalysts, MRI medical equipment, microphones, hearing aids, nuclear reactor control cylinders, fibre optics...

Despite their name, these are not products that are in short supply in the earth's crust. Many of them are quite common and are found in a multitude of rocks in the form of oxides. The problem is that they are found in minute proportions and their low concentration makes their extraction, processing and separation extremely complex, costly and polluting.

In fact, they have been used as economic weapons on several occasions: in 2010, China restricted their export to Japan over a territorial dispute and, in 2019, it used them as a political weapon in its trade war with the United States.

Rare earths production rose to around 300,000 tonnes in 2022 worldwide. Of this, some 210,000 tonnes were mined in China (70 per cent of the total), followed by some 43,000 tonnes in the United States (14 per cent) and 18,000 tonnes in Australia (6 per cent).

As for the figures for world reserves in 2022, they are estimated at around 130 million tonnes of rare earth oxides, of which 44 million tonnes are in China, 22 million tonnes in Vietnam, 21 million tonnes in Brazil and 21 million tonnes in Russia. Thus, between them, the four countries account for 83% of the world's known reserves.

Cobalt

Cobalt production has increased significantly in recent years: from 142,000 tonnes in 2020 to 165,000 tonnes in 2021 and 190,000 tonnes in 2022.

Cobalt is, together with lithium and graphite, a key material in the lithium-ion battery industry. But it is also used in the aerospace industry for its mechanical properties, in the chemical industry as a catalyst, in medicine, in the glass industry, in the production of high-strength steels and cutting tools, and even in jewellery.

The world's leading producer, with 130,000 tonnes in 2022, is the Democratic Republic of Congo (DRC), 68% of global production. The rest is distributed among many countries such as Indonesia, Russia, Australia and the Philippines. However, it should be noted that 70% of the mines in the DRC are owned by China and exclusively supply Chinese refineries. In terms of known world reserves, 48% of the total of 8.3 million tonnes is in the DRC and 18% in Australia.