Global supply chains have suffered a series of crises that have shaken the world of transport and procurement. (GettyImages)

Global supply chains have suffered a series of crises that have shaken the world of transport and procurement. (GettyImages)

Seven crises for the seven seas: how a disrupted world stresses port logistics

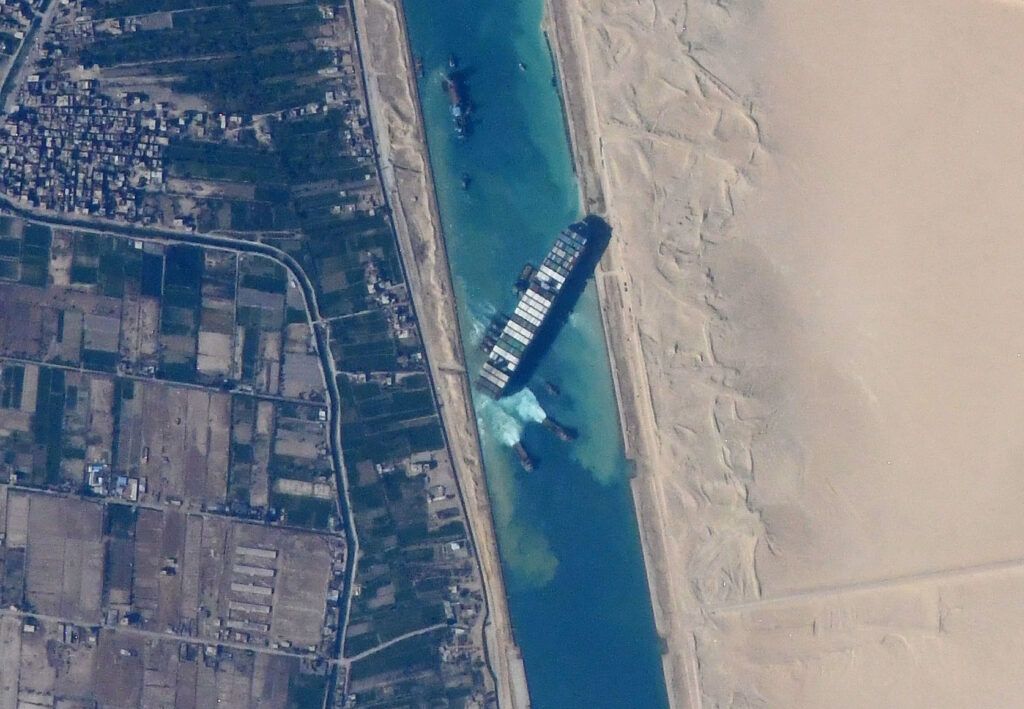

Global supply chains have recently been subjected to a series of crises that have shaken the world of transport and procurement. The Covid-19 pandemic, for starters. Then the Ever Given incident in the Suez Canal. Then the temporary closure of Chinese ports such as Yantian or Ningbo and the congestion in ports such as Los Angeles or Long Beach. Brexit added to the shortage of transport drivers in the UK. And, in addition, the price of sea freight, blank sailings, hurricanes and various storms...Today's maritime logistics can be explained through this compendium of disruptions.

Carles Rúa is the Chief Innovation Officer at the Port de Barcelona and Director of the Master’s degree in Executive in Supply Chain Management at the UPC.

Global supply chains have suffered a series of crises that have shaken the world of transport and procurement. (GettyImages)

Global supply chains have suffered a series of crises that have shaken the world of transport and procurement. (GettyImages)

Ports have not been unaffected by these events; on the contrary, in some cases they have been major players in this new global scenario.

The Port of Barcelona has identified seven types of crisis in the face of which it has had to show its most resilient side:

- the health crisis

- the economic crisis

- the energy crisis

- the materials crisis

- the logistics crisis

- the geostrategic crisis

- the climate crisis

1. The health crisis

The Covid-19 pandemic has had a very negative impact on supply chains in its early stages, with the first strict confinements and the lack of some products on some supermarket shelves.

However, logistics in general and port operations in particular overcame the initial situation with a good mark. They showed their resilience and highlighted the importance of the logistics sector to the general public, as it often does not receive the consideration it deserves.

With the exception of some traffic segments such as cruises, which will take time to fully recover, the low traffic in 2020 have been compensated, in some cases generously, with increases throughout 2021.

In the absence of knowing how new waves or variants of the coronavirus may affect us, we must bear in mind that, even if we can overcome this crisis, Covid-19 has been the spark that has set off all the other crises listed below, with the difference that for the rest there are no vaccines available.

2. The economic crisis

The confinements and mobility restrictions resulting from the pandemic caused global GDP to fall by 3.5% in 2020, more sharply in developed economies as a whole than in emerging economies. The global economy is expected to rebound strongly, above 5%, in 2021, with a significant increase in demand.

However, the recovery will be very heterogeneous and will be accompanied by high uncertainty. The recovery in China is likely to be very strong, in most developed countries it will be moderate, and in some of the major emerging powers it will be weak.

But not all of the crisis is due to the pandemic, even if it was the trigger. Certain sectors had closed the previous crisis in 2009 on a false note and were, in general, unprepared for the new challenges that lay ahead and which required an urgent reconversion.

This is the case, for example, of the automotive industry, which is facing a change in its global business model: energy transition, electric vehicles, connected vehicles.

Perhaps these are not seven separate crises but seven faces of the same global crisis

3. The energy crisis

In recent months we have witnessed an unprecedented increase in energy prices, which has had a direct impact on the pockets of individuals and has led to a general increase in fuel prices at sectoral level.

To this increase we must add supply problems. For example, the termination of the contract with Morocco that allowed gas to be transported to Spain via the Maghreb-Europe gas pipeline (GME) or the lack of supply at petrol stations in the United Kingdom.

In the maritime environment, in addition to the impact that the cost of fuel has on the final costs of transport, price variations are causing some setbacks in the use of alternative fuels. For example, dual-engine ships that used to run on LNG (liquefied natural gas), which emits less polluting gases, are switching back to fuel oil because of the change in the cost price between the two.

4. The materials crisis

The energy transition on the one hand and the circular economy on the other will change the pattern of maritime transport in the coming years.

The former will reduce the movement of petroleum-based products or bulk goods such as coal, which will gradually be replaced by other fuels (hydrogen? ammonia? methanol? ).

The second will reduce external imports. As a result, part of domestic consumption will come from recycled products, as is the case, for example, of iron or aluminium.

But if this evolution is expected to take place gradually, the shortage or lack of access to other materials may lead to more dramatic situations.

This is the case of new industries such as the manufacturing of electric batteries, wind turbines, photovoltaic panels, 3D printing, etc., which require scarcer raw materials (rare earths, niobium, germanium, borates, cobalt, vanadium, gallium, lithium) whose supply is by no means guaranteed and whose logistics may suffer serious tensions in the future.

For example, with regard to rare earths (consisting of 17 chemical elements, scandium, yttrium and the 15 elements of the lanthanide group), China produced nearly 60% of the world's volumes in 2019.

5. The logistics crisis

The logistics crisis has its origins in the decoupling of transport supply and demand. Although the early stages of the health crisis reduced demand for products that the maritime sector resolved with a controlled reduction in supply (withdrawal of ships, elimination of stopovers, etc.), the gradual return to normality generated a substantial increase in demand that has not been met by supply with the same agility. This has had a negative impact on delivery times and reliability.

To this all we have to add a demand that increasingly requires more flexibility and punctual deliveries (e-commerce, last mile distribution problems, etc.), in contrast to an increasingly rigid maritime transport supply, with mega-ships of more than 20,000 TEU capacity, reduced stopovers, etc. and problems linked to the shortage of certain logistical resources. This is the case of the lack of heavy goods drivers which, although widespread, in certain regions such as the United Kingdom has generated serious supply problems.

This generates a bullwhip effect in which, given the unpredictability of delivery times, logistics chains try to oversupply, increasing their safety stocks, generating in turn a new artificial demand.

We have also seen the consequences in the news: dozens of ships waiting in front of ports on the West Coast of the United States with waiting times that can exceed fifteen days. This, in turn, makes logistical forecasting difficult. The result is a perfect vicious circle.

All of this in turn generates other pernicious effects: lack of empty containers, exorbitant increases in freight rates, increased transit times, traffic diversions, cancellations of stopovers, stock outs, temporary closures of assembly plants due to a lack of components, etc.

And although we are focusing on the maritime sector, let us not forget that logistical problems also affect other modes of transport: this is the case of the lack of drivers, or the lack of cargo capacity that the reduction in passenger flights, which in many cases also carry cargo, has caused in air transport.

When we speak of a new normality, we must bear in mind that, in the logistics sector, frequent disruptions will be the differentiating element of this new reality

6. The geoestrategic crisis

At the geostrategic level, two opposing trends are emerging.

On the one hand, the rise of economic nationalism in some regions (Brexit, America first, growth of authoritarianism in some European countries).

On the other hand, with China leading the way, other nations are opting for greater commercial expansionism. The New Silk Road Initiative (BRI: Belt and Road Initiative) is a clear example of this attempt to control the world's main shipping routes.

The bloc dynamics are thus changing. In the middle we find a dispersed Europe that finds it difficult to counteract these global tensions through a common policy.

7. The climate crisis

Climate change is probably humanity's greatest current challenge. Caused by global warming, which in turn is a consequence of massive emissions provoked by greenhouse gases into the atmosphere resulting from human activity, the effects of the climate crisis can be seen through a sustained increase in extreme weather events, rising sea levels, loss of biodiversity, destruction of terrestrial and marine ecosystems...

Perhaps we should be reminded that 2020 has seen the most active Atlantic hurricane season on record. Exceptionally heavy rains in East Africa have led to severe flooding and the largest locust infestation in decades. Last year also saw the longest fire season in Australia's history.

In this case, Europe has decided to take the lead in the crisis and has set the goal of becoming the first climate-neutral continent by 2050 with very ambitious decarbonisation targets in the shorter term (2030). But the implementation of these necessary measures and, above all, the way in which they are applied, can have important consequences for supply chains.

One example of this is the proposal, currently under discussion within the European Commission, to implement an emissions tax on maritime transport, a sector that has been exempt from it until now.

Depending on how the tax is applied, the Mediterranean ports fear a shift of long-distance traffic to North Africa, where these taxes will not apply. From there the goods will be transported to Europe, paying minimal charges, as the route is much shorter. But it will increase the overall transit time of the goods from origin to destination and will have the opposite effect to that desired by the measure, i.e. it will increase emissions due to the longer overall itinerary of the goods.

Perhaps these are not seven separate crises but seven sides of the same global crisis. In any case, their combined effects will not be resolved in the short or medium term. In short, when we speak of a new normality, we must bear in mind that, in the logistics sector, frequent disruptions will be the differentiating element of this new normality.

The answer: resilience.